AUDUSD Monday 23rd June: Weekly technical outlook and review.

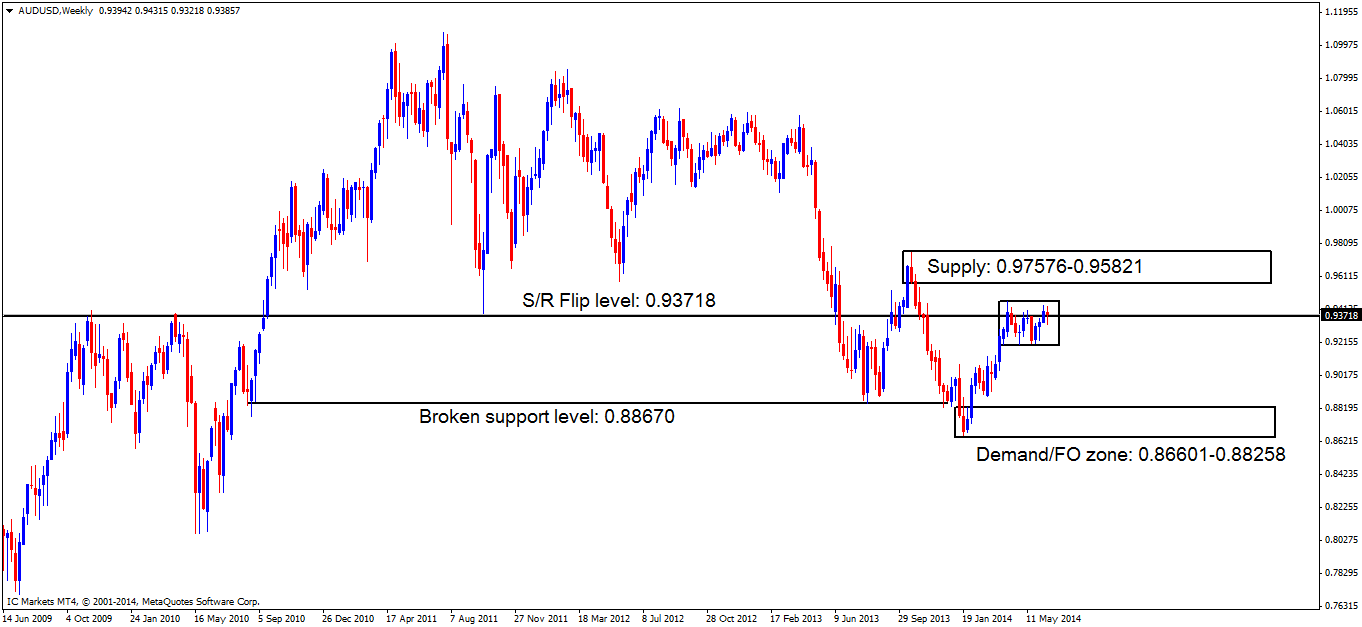

Weekly TF.

Price has not seen much change since the last weekly analysis, as price continues to consolidate in and around the weekly S/R flip level at 0.93718. Keep watching this consolidated area for a positive break either above or below the limits, because this may give us an idea on possible long-term direction.

Daily TF.

The daily timeframe shows sellers seem to be struggling to keep control around the daily supply area at 0.94468-0.93758, with the buyers appearing too strong on this occasion.

A piece from last week’s analysis that is worth remembering:

The circled wick to the left could be a sign that the aforementioned supply area is weak. This spike could have likely consumed the majority of sellers in and around this area, indicating pro money may likely push prices higher to at least fresh supply above at 0.95434-0.94862 which may even be a fakeout to push prices lower, only time will tell.

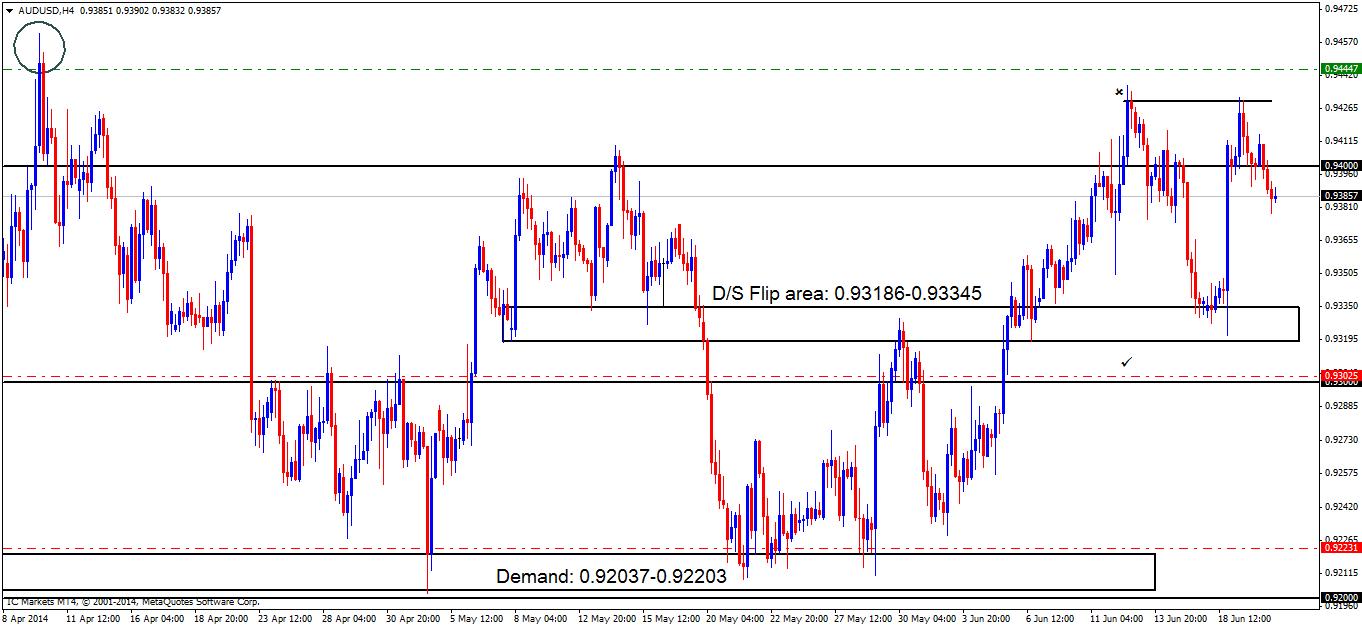

4hr TF.

There were clearly active sellers around the highs marked with an x at 0.94299 as a beautiful bearish reaction was seen.

This however, does not mean the highs above at 0.94613 will not be hit, as this could still be beneficial for pro money, as they still may decide to fake these highs up to the next set of highs at 0.94613 (circled to the left). If we think about this logically for a moment, there are clearly sellers at the highs marked with an x (0.94299), this means there will also be buy stops just above the actual high at 0.94375, and also breakout buyers’ orders, with the high at 0.94613 being seen just above this is a perfect fakeout zone for pro money as they need all those buy orders to sell into! So do be on your guard for this to possibly happen sometime this week.

Price is currently capped between supply at 0.94299 and demand (D/S flip area) at 0.93186-0.93345. A break below this demand area will possibly force price to test the round number below at 0.93000, conversely, a break above supply (highs) would likely see price testing the oncoming highs at 0.94613 marked with a circle to the far left.

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen at 0.92231 just above demand at 0.92037-0.92203. It would be too risky to set a pending order around this area, since deep spikes into this demand zone have been seen (levels above) possibly consuming the majority of buyers in the process.

- P.A confirmation buy orders (Red line) are visible just above the round number 0.93000 at 0.93025. We require confirmation of this level because previous price action has warned us deep tests both north and south happen on a regular basis, hence the need to wait for confirmation rather than getting stopped out time after time through lack of patience.

- Pending sell orders (Green line) are seen at 0.94447, if price manages to get up to this level, active sellers are likely waiting because of how quickly price changed in direction, only pro money have the account size to do this, indicating unfilled sell orders may still be unfilled there.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

The weekly timeframe shows price is currently consolidating around weekly resistance at 0.93718 and the daily timeframe shows price is currently trading within weak supply at 0.94468-0.93758. Today, price will likely remain trading between the highs/close at 0.94375/0.94299 and demand (D/S flip area) below at 0.93186-0.93345, with a break above the highs (level above) being more likely before we see a break of demand (levels above) below, due to weak daily supply (levels above) as explained in the detailed analysis above.

- Areas to watch for buy orders: P.O: No pending orders are seen with current price action. P.A.C:0.92231 (SL: more than likely will be at 0.91984 TP: Dependent on approaching price action after the level has been confirmed) 0.93025 (SL: Dependent on approaching price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 0.94447 (SL: 0.94667 TP: Dependent on approaching price action). P.A.C: No P.A confirmation sell orders seen in the current market environment.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Sources: IC Markets Trading Desk