Bank Of Israel Says Virtual Currencies Can Be Financial Asset, Not Currency

Bank of Israel Deputy Governor Nadine Baudot-Trajtenberg said on Monday that cryptocurrencies are not currencies, but can be viewed as a financial asset with its inherent risks.

Speaking to the Knesset Finance Committee, Baudot-Trajtenberg said,”Bitcoin and similar virtual currencies are not a currency, and are not considered foreign currency.”

“The Bank of Israel’s position is that they should be viewed as a financial asset, with all that this entails.”

Citing the huge investor interest in virtual currencies, mainly among young people, she said it was very important that anyone considering this should be aware that there is no government responsibility for these activities.

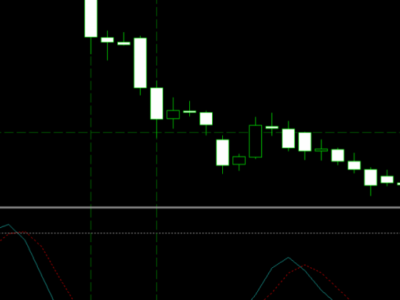

Further, people investing in virtual currencies should take into account that the high level of volatility and the lack of supervision may lead to a sudden loss of value, she added.

In contrast to the confidence in real currencies that are legal tender, Bitcoin and its peers are characterized by higher volatility, difficulty in making transactions, and a lack of certainty regarding the parties that stand behind it, the central banker stressed.

Baudot-Trajtenberg also noted that the anonymous nature of virtual currencies leads to the possibility that they may be used to launder money, finance crime, and so forth. If the money is used for an inappropriate purpose, the bank that made the transfer may bear responsibility, she warned.

The official urged banks to use cautionary measures to prevent money laundering and the financing of terrorist activities, using virtual currencies. The transfer of virtual currency can be considered as the transfer of cash, and such a bank account can therefore be considered a high-risk account, she added.

The Banking Supervision department has established an internal team to examine and study the matter, and the team is beginning its work, Baudot-Trajtenberg said.

The recent rise of the cryptocurrencies prompted authorities in different countries from China to Australia to issue warnings against the use of such currencies. Elsewhere on Monday, South Korean regulators announced that they were probing six retail banks that were providing virtual accounts to cryptocurrency exchanges.

The announcement caused a major slide in the price of various cryptocurrencies as South Korea is a main market for them.

The fact that no banking regulator in any country has been able to issue guidelines regarding virtual currencies suggests that there is a real difficulty in issuing sweeping guidelines to the banking system regarding the proper way to estimate, manage, and monitor the risks inherent in such activity, she said.

Late December, the country’s stock market watchdog sought a ban on companies trading in cryptocurrencies from listing on the Tel Aviv stock exchange. The Israel Securities Authority also wanted a suspension of such firms currently operating on the stock exchange.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Bank Of Israel Says Virtual Currencies Can Be Financial Asset, Not Currency