Bitcoin Elliott Wave analysis for 17/01/2019

Market technical overview:

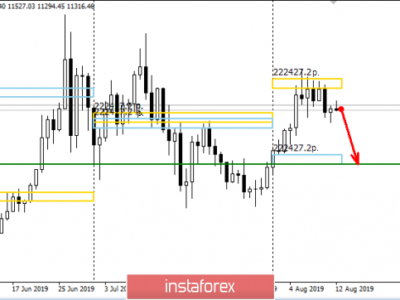

The impulsive wave up has been completed at the level of $4,200 and then the Bitcoin market has made the three waves corrective pattern to the downside. The correction has reached the level of 61% Fibo and made a new local low at the level of $3,438. This level is the bullish impulsive count invalidation level now as any violation of this level would lead to the impulsive scenario invalidation due to wave 1 and wave 2 potential overlap.

The bulls will have to break out above the resistance mode established between the 38% Fibo at $3,682 and local technical resistance at the level of $3,640. This zone must be clearly violated in order for bulls to move higher towards other Fibonacci retracements are reached at $3,757 and $3,832.

Recommendations:

There is still a chance for an impulsive wave progression to develop to the upside, so long positions should be in play as long as the level of $3,438 is clearly broken. Targets for bulls are seen at the levels of $3,682, $3,757 and $3,832. Violation of the level of $3,438 invalidates the bullish impulsive scenario and then short orders should be in play with targets at the level of $3,223.

The material has been provided by InstaForex Company – www.instaforex.com