Daily analysis of major pairs for June 19, 2017

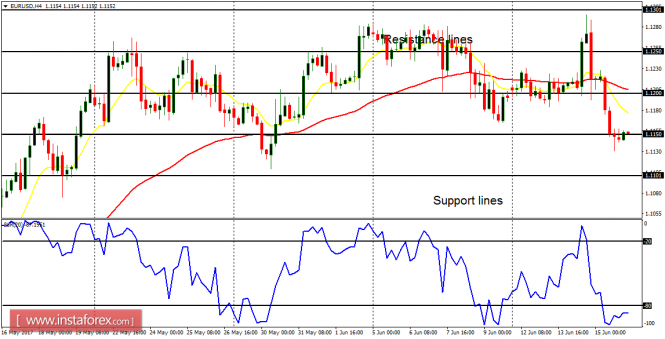

EUR/USD: This pair moved

sideways last week – in the context of an uptrend. The outlook on EUR pairs is

bearish for this week, and this may make the EUR/USD go southwards, causing a

bearish bias to form in the market. Further southwards movement is thus

expected.

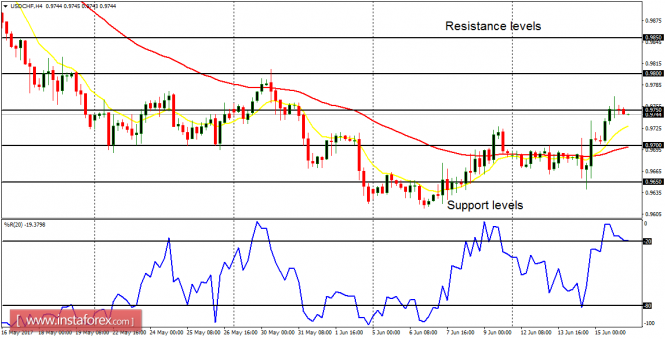

USD/CHF: Last week, the

USD/CHF consolidated in the context of a downtrend, with price making a faint

bullish effort in the last few days of the week. The outlook on the market is

bullish for this week, and this could put an end to the bearish bias, especially

as price goes above the resistance level at 0.9900. Two factors would help

realize the bullish outlook: When the EUR/USD drops, the USDCHF would be helped

upwards. Then CHF itself could become somewhat weak this week, and that may

help USD to the upside.

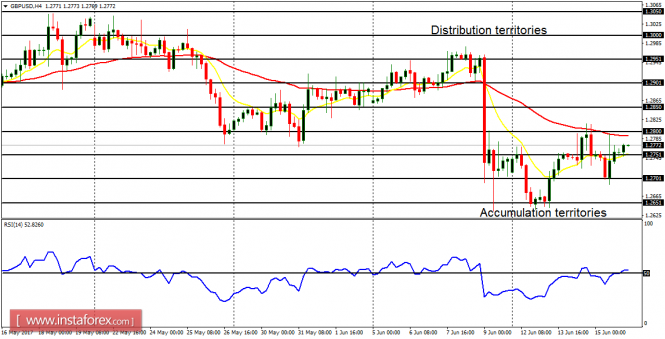

GBP/USD: The GBP/USD is a

volatile market, and price did not a make a significant directional bias last

week. This has forced the market to enter a neutral bias in the short-term.

There would be an end to the neutral bias when the accumulation territory at

1.2600 is breached to the downside, or the distribution territory at 1.2900 is

breached to the upside. As long as one of these things does not happen, the

bias would remain neutral.

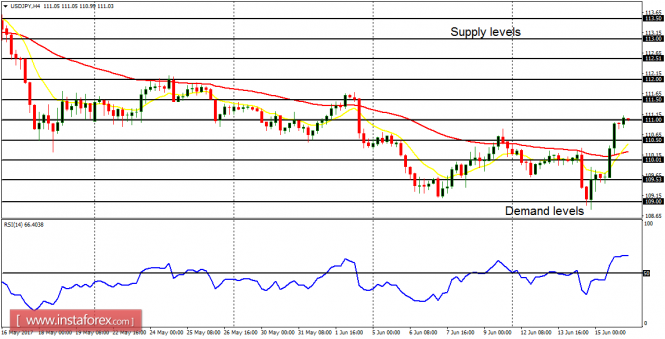

USD/JPY: This currency trading

instrument made attempts to go upwards on Thursday and Friday, but that did not

override the bearish outlook on the market. Rally attempts should be

disregarded, for that could turn out to be short-selling opportunities, for the

outlook on JPY pairs is also bearish for this week.

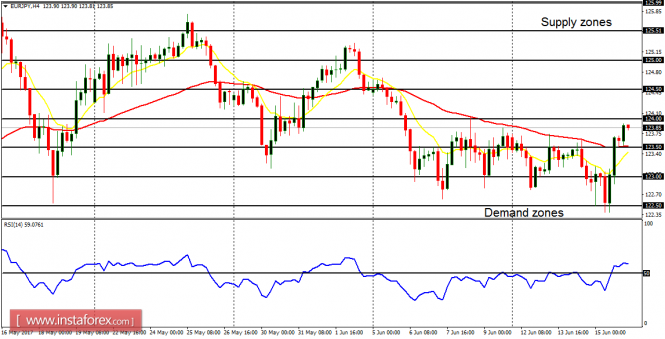

EUR/JPY: The bias in the

EUR/JPY cross remains bullish in spite of the threats to it. The cross closed

above the demand zone at 124.00 on Friday, and it may even reach the supply

zones at 124.50 and 125.00. However, the market is not expected to trade

upwards significantly. Once the market drops below the demand zone at 121.00,

the bias on the market would turn bearish. Any gains of stamina on the Yen

would cause the market to shoot downwards.

The material has been provided by InstaForex Company – www.instaforex.com