EURGBP Monday 23rd June: Weekly technical outlook and review.

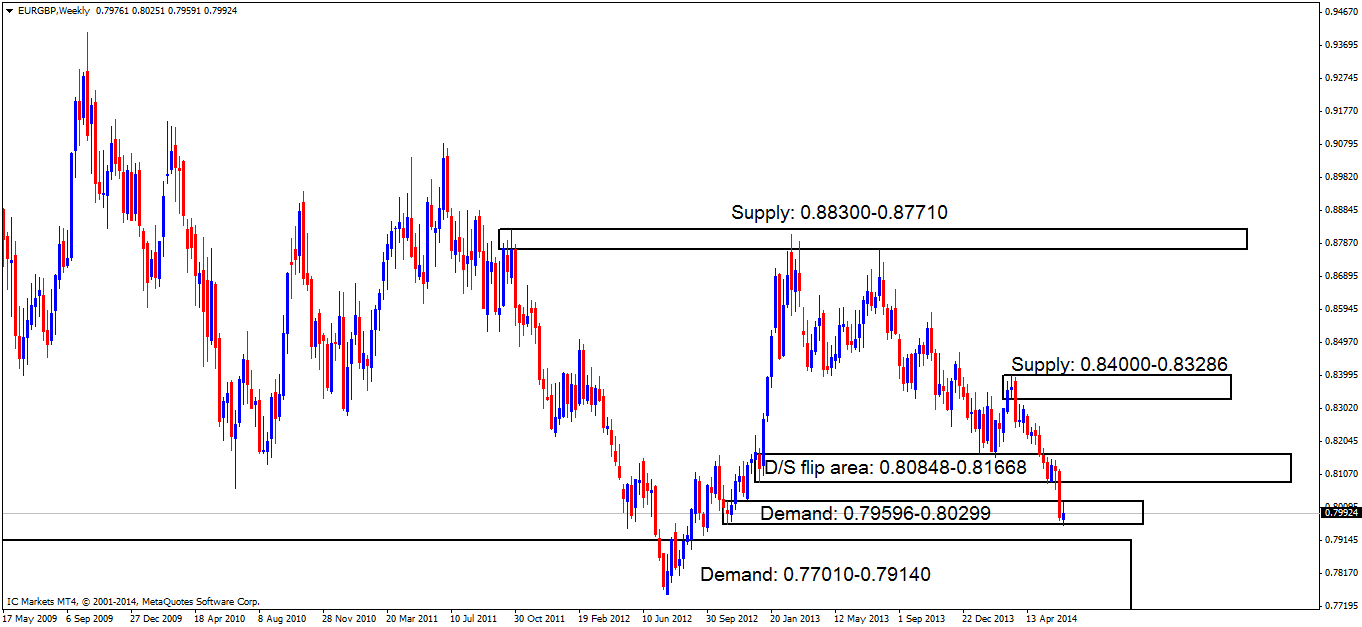

Even though we are in higher-timeframe demand at 0.79596-0.80299, the sellers were still active, take a look at the most recently closed weekly candle, notice the wick? This indicates the possibility a break below this weekly demand area (levels above) may be seen sometime soon.

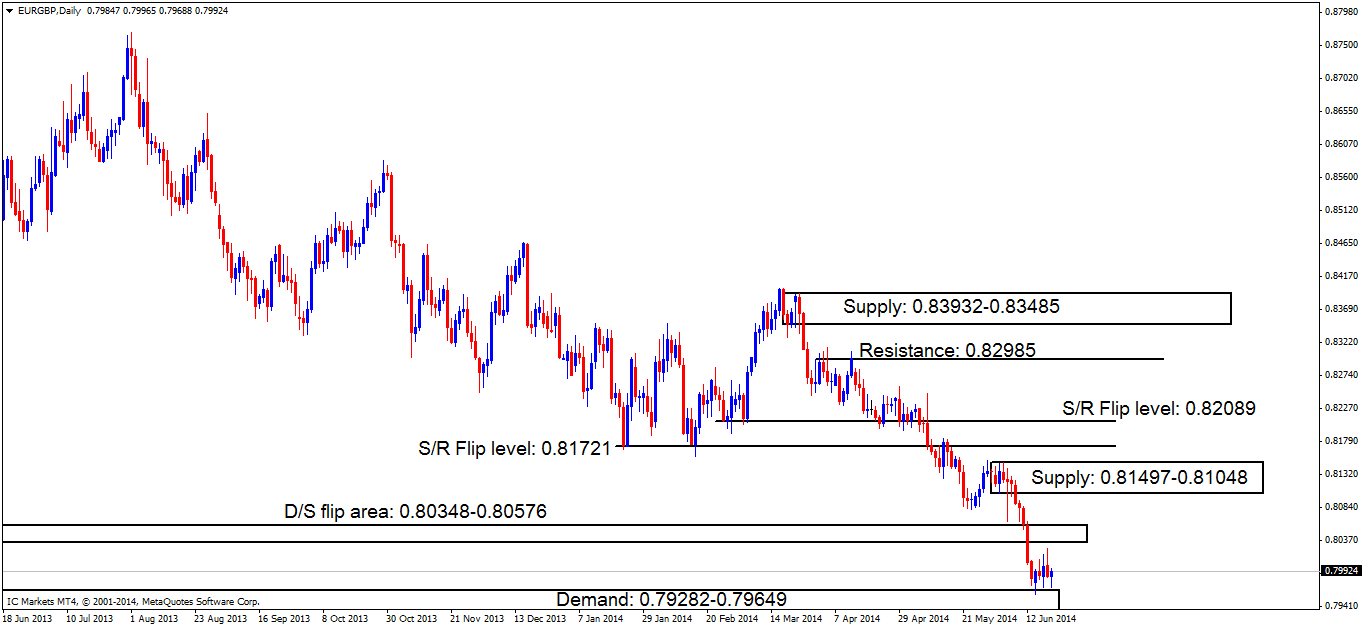

Daily TF.

Active buyers were seen within daily demand at 0.79282-0.79649; however, sellers were also active at the same time causing price to form wicks and tails in both directions. If buyers do regain control here, the first trouble area on the horizon is supply (D/S flip area) at 0.80348-0.80576.

If a break below demand (levels above) is seen, price could be forced to test major support below at 0.77533 (not seen on the chart); conversely, a break above supply (levels above) may see price testing oncoming supply at 0.81497-0.81048.

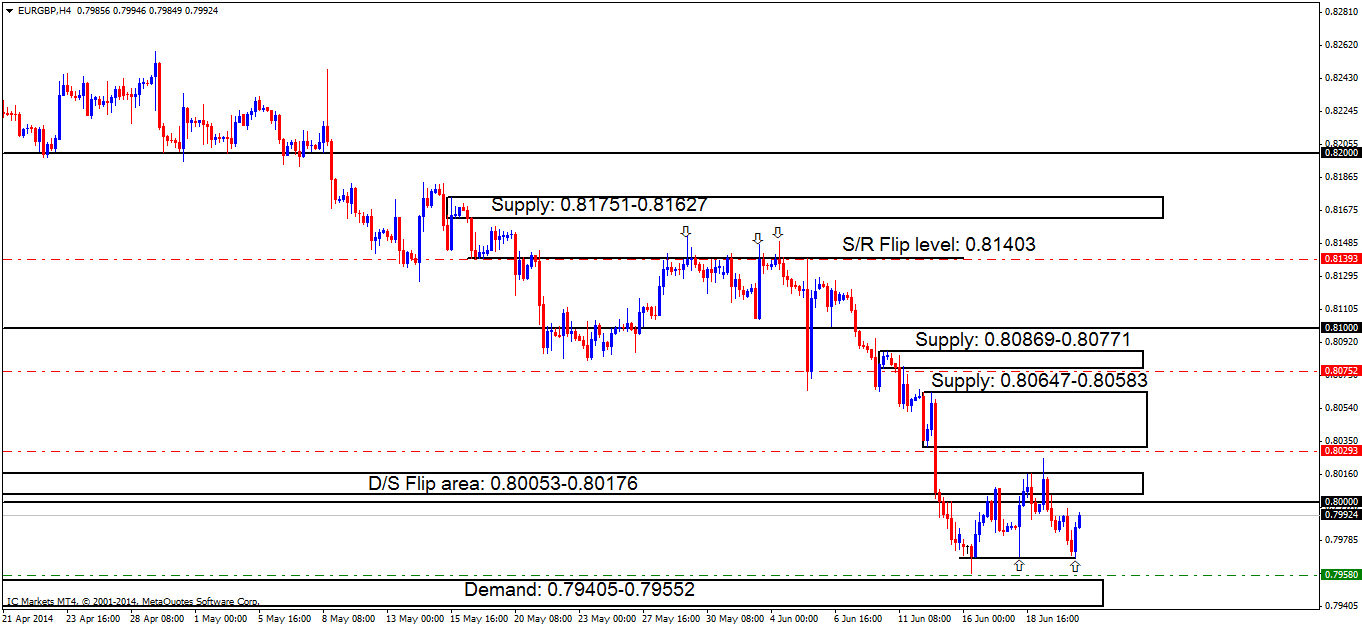

4hr TF.

Friday’s analysis reported the following:

If price manages to get back down to the ‘decision point’ area (marked with a horizontal level) at 0.79689, we may see pro money fake past this level into true demand at 0.79405-0.79552. Consequently, this will stop out the majority of the buyers around this area, giving pro money their stops which would be sell orders, for them to buy into, thus supplying the pros with the liquidity they need to push prices higher.

Price did indeed manage to get back down to the decision point area at 0.79689 (marked with the arrow furthest to the right), but there was clearly enough unfilled buy orders remaining there, as no fake below this level into demand (0.79405-0.79552) was seen.

Not all is lost though! Considering we are in higher-timeframe demand on both the daily and the weekly timeframes (levels above), albeit possible weak demand, price on the 4hr timeframe could very well still fake the decision point area at 0.79689 into demand below at 0.79405-0.79552, as the buy orders that were there may not have been enough to fill pro money’s requirements, so a retest may be in order.

Pending/P.A confirmation orders:

- A pending buy order (Green line) has been set at 0.79580 just above demand at 0.79405-0.79552. The rationale behind this is because buyers have likely consumed the majority of the sellers lurking around supply (D/S flip area) at 0.80053-0.80176, likely clearing the path for higher prices. A small retracement will possibly be seen to collect more buyers for a rally higher, thus triggering our pending buy order.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- No pending sell orders (Green line) are seen in the current market environment.

- P.A confirmation sell orders (Red line) under the S/R flip level 0.81403 at 0.81393 is an area where a reaction is likely, however there were too many wicks north seen marked with arrows, indicating sellers are drying up, thus, the need to wait for more confirmation.

- P.A confirmation sell orders (Red line) are seen just under supply (0.80869-0.80771) at 0.80752. Confirmation orders were used here because price is trading around a weekly demand area (0.79596-0.80299), which means price could easily consume this supply level as the higher timeframes usually overrule the lower timeframes.

- P.A confirmation sell orders (Red line) are seen just below supply (0.80647-0.80583) at 0.80293. Confirmation orders were used here because price could easily consume this supply level as we are currently deep within a weekly demand area (0.79596-0.80299), which means price could easily consume this supply level as the higher timeframes usually overrule the lower timeframes.

Quick Recap:

With price being seen in higher-timeframe demand (Weekly: 0.79596-0.80299 Daily: 0.79282-0.79649), we may see higher prices soon, however, do be aware these higher-timeframe demand areas are not portraying bullish strength at the moment. Price will likely see a bearish reaction off of the round number above at 0.80000, then drop hard towards demand at 0.79405-0.79552, thus filling our pending buy order set at 0.79580.

- Areas to watch for buy orders: P.O: 0.79580 (SL: 0.79368 TP: [1] 0.80000 [2] 0.80583 [May change if any new developments in the market are seen]) P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders are seen in the current market environment. P.A.C: 0.81393 (SL: Will be likely set at 0.81564 TP: Will be likely set at the round number 0.81000) 0.80752 (SL: likely to be set at 0.80900 TP: Dependent on where price ‘confirms’ the level) 0.80293 (SL: likely to be set at 0.80648 TP: Dependent on where price ‘confirms’ the level).

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Sources: IC Markets Trading Desk