Euro Breaks Through Trend Line

Yesterday”s Trading:

On Monday the euro/dollar spent the evening in a sideways after reaching 1.1144. This was due to low activity due to it being a day off in the US. The time has come for traders to gear up for the ECB meeting and Mario Draghi”s press conference on Thursday. It is expected that the key rates will remain the same. The ECB should also publish forecasts for economic growth and inflation in the Eurozone.

Market Expectations:

The euro/dollar rose to 1.1154 in Asia. The GBP rally was facilitated by a rise in the price of gold, oil and other key currencies against the dollar. The Daily Telegraph in the UK published its Brexit survey conducted by the sociological service, ORB. According to the survey, the number of Brits ready to vote leave has risen to 46%, with in voters at 51%.

The tip of the balance was small, but the pound used it to rise 90 points to 1.4724. With the survey played out, the euro/dollar ricocheted back to the trend line. On Tuesday I”d risk saying there”ll be a weakening of the euro against the US dollar to 1.1115. Today the month”s candle is closing. The buyers won”t make a bull signal of it, even if they try. The target for the next two days remains at 1.1085.

Day”s News (EET):

- 10:55, German April unemployment changes;

- 12:00, Eurozone May preliminary CPI and April unemployment level;

- 15:30, Canadian GDP changes in March and Q1;

- 15:30, US April CPI, consumer incomes/spending in April;

- 16:45, US Chicago May business activity index;

- 17:00, US consumer confidence in May from The Conference Board.

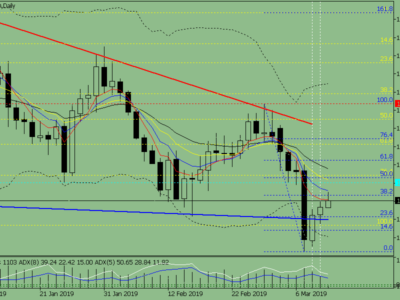

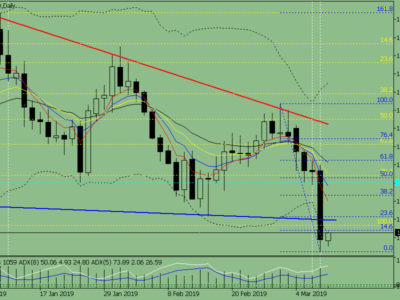

Technical Analysis:

Intraday forecast: minimum: 1.1134 (current Asian), maximum: 1.1175, close: 1.1162.

Euro/dollar rate on the hourly. Source: TradingView

The euro/dollar has met a resistance near the trend line at the 15 degree Gann level: 1.1150. For the buyers to stop purchasing euro, the sellers need to get the rate below 1.1127 asap. In this case new market participants will get involved and we could see a fall to 1.1085. I limit myself to 1.1116 but here we need to keep an eye on the GBP and euro/pound cross movements. Any general dollar strengthening will see a euro fall even further than the pound. The closest target for the next two days is still at 1.1085. I expect to see trader activeness up on the American session.

Source:: Euro Breaks Through Trend Line