Financial Market Outlook: October Edition

Financial Market Outlook: October Edition

After a volatile start to the autumn trading season, investors will look to the month of October for a semblance of calm on Wall Street and across the global financial markets. Below is a brief snapshot of the key market-moving events scheduled for October.

October 3

The month kicks off with a report on Australian inflation for the month of September. In the absence of official monthly CPI data, the TD Securities Inflation report is closely monitored by the financial markets.

A deluge of manufacturing PMI reports for the Eurozone and United States will also be released.

October 4

Australia continues to make headlines on the first Tuesday of October when the Reserve Bank releases its latest interest rate statement. The Reserve Bank of Australia (RBA) slashed interest rates to a record low of 1.5% in August, and will be closely monitoring the economic data to determine if future cuts are necessary.

October 5

Global PMI reports and UK manufacturing production make headlines on October 5. The European Central Bank (ECB) will also release the Monetary Policy Meeting Accounts, which provide an overview of economic and policy-related developments.

October 7

The first Friday of every month is synonymous with US nonfarm payrolls. The September jobs report will be especially critical for the Federal Reserve, which is still deliberating whether to raise interest rates before year-end.

October 12

The Federal Reserve voted to leave interest rates unchanged at the conclusion of its September 20-21 FOMC policy meeting. The minutes of that meeting, which provide a more in-depth account of the deliberations behind the decision, will be released October 12.

October 13

After the second Golden Week celebrations of the year, the Chinese government returns with a closely followed report on trade. The world’s second-largest economy will report on exports and imports October 13.

In Europe, Germany will release final CPI inflation data for the month of September.

October 14

Chinese reports on producer and consumer inflation will make headlines on Friday. Factory-gate inflation has been improving gradually in recent months, raising optimism that the worst of the manufacturing slowdown had ended.

In the United States, data on retail sales, producer inflation and business inventories will make headlines.

October 17

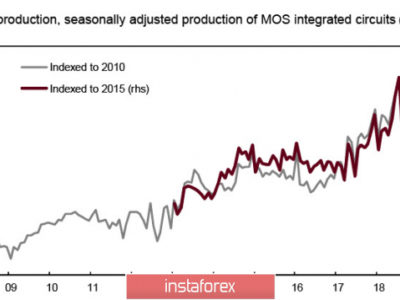

The third week of October begins with reports on Japanese industrial production, final Eurozone September PMI and US industrial production figures. These reports could impact everything from stocks to currencies, giving investors more insights about the strength of regional economies.

October 18

Two weeks after holding its policy meeting, the RBA will release the minutes of the meetings, which could provide clues about future monetary policy.

Inflation data from the United Kingdom and United States will also be released the same day. These reports are closely followed by currency traders.

October 19

Traders will mark October 19 on their calendars. The day begins with a report on Chinese third quarter gross domestic product (GDP). As the world’s second-largest economy, Chinese GDP data impact global markets. China’s GDP growth beat estimates in the second quarter.

In addition to GDP, China will also report on retail sales, industrial production and urban investment.

Meanwhile, the UK Office for National Statistics will release its latest employment figures.

The Bank of Canada’s rate decision and Monetary Policy Report are also expected to move the financial markets.

October 20

October 20 is another jam-packed day in the markets, beginning with Australian employment data. Australia’s employment picture weakened unexpectedly in August, and investors will look to the September data for clues about the performance of the economy.

After failing to extend its quantitative easing program in September, the European Central Bank (ECB) will hold its latest policy meeting. The ECB is expected to stand pat on monetary policy for the time being.

In economic data, UK retail sales, German producer inflation and US housing sales will make headlines.

October 21

Preliminary US manufacturing PMI and Canadian inflation figures are on the economic docket Friday, October 21.

October 24

Traders’ attention shifts to Japanese economic data October 24, where the Ministry of Finance will release its latest trade figures. Separately, Markit/Nikkei will release preliminary October manufacturing PMI.

October 26

The RBA will release its closely followed quarterly inflation report Wednesday, October 26. With inflationary pressures weakening, the RBA has slashed interest rates multiple times this year to boost economic growth. The official CPI report will provide investors with a sense of direction on RBA policy.

October 27

UK preliminary third quarter GDP will be released on the final Thursday of the month. The Q3 report will provide investors with their first clues about the performance of the UK economy after the June 23 Brexit vote.

October 28

The month draws to a close with a preliminary report on US third quarter GDP. The world’s largest economy underwhelmed investors in the first half of the year. The Q3 report could provide insights about the Fed’s intention to raise rates before the end of the year.

Source https://www.easymarkets.com/eu/financial-calendar/

The post Financial Market Outlook: October Edition appeared first on Forex.Info.