Forex Trading: USD/JPY Steady As Markets Look For Direction

USD/JPY Steady As Markets Look For Direction

- Activity remains sluggish, as markets return to normal trading volumes.

- Lack of market-moving data reports in Asia suggests JPY will follow trends determined by sentiment in USD.

Forex markets are trading water to start the Asia session, as the USD/JPY is caught in a tight 112.48-112.61 forex trading range to start the day. The relative ambivalence here suggests that traders are paring the lackluster reaction generated by the latest FOMC meeting minutes, as there is nothing in the release to materially sway the dominant trader outlook.

On balance, economic data during the North American session was USD bullish, and this has helped to bring some support back for dividend stock benchmarks and the long-beleaguered greenback. ISM manufacturing data for December came in very strong (59.7 vs. expectations of 58.2), MBA Mortgage Applications posted monthly gains of 0.7%, and US construction spending rose 0.8%. The figures are particularly important, given the declines seen in the previous data reports and this indicates continued strength for the rebounds seen in US housing markets.

Looking ahead, we may continue to see more trader reluctance into the final parts of the week as the US Non Farm Payrolls data will go far to influence risk sentiment and broader valuations in the USD/JPY. Markets are looking for 188K jobs created for the month of December, and any weakness here could lead to further declines in the USD/JPY. In Japan, the data calendar is light and so we could see USD-related flows become the key determinant of the trend direction that is seen for the remainder of the Asia session.

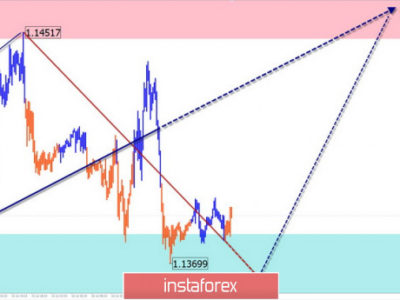

USD/JPY Technical Outlook

On the longer-term forex charts, the USD/JPY is heading toward the middle of its 52-week trading range (107.32-118.19) in moves that are forming an asymmetrical triangle consolidation pattern. But as we head toward the apex of that triangle, a forceful breakout becomes more likely and this is likely to influence of the activity seen in peripheral pairs like the EUR/JPY and GBP/JPY. The USD/JPY is bouncing off its lower Bollinger Band on the daily charts, forming what could become support at 112.10 given the fact that this is where the rising 200-day EMA currently rests. RSI readings are holding at 47, supporting the sideways outlook for the pair.