Fundamental Analysis of AUDUSD for March 1, 2018

AUD/USD has been quite impulsive with bearish gains that has lead the price to breach 0.7750. below USD has been the dominant currency in the pair whereas AUD has been struggling. AUD lost good amount of grounds today having weak economic reports. Today AUD Private Capital Expenditure report was published with the 0.2% decrease from the previous rise of 1.9% which was forecasted to be at 1.0%. AIG Manufacturing report was published with a decrease to 57.5 from the previous figure of 58.7; and Commodity Prices had a slight increase to -1.0% from the previous value of -1.1%. On the other hand, ahead of the upcoming Interest Rate hike on March, USD has been quite strong with the gains and expected to dominate further. Today USD ISM Manufacturing PMI report was published with an increase to 60.8 from the previous figure of 59.1 which was anticipated to decrease to 58.7. Construction Spending is expected to decrease to 0.0% from the previous value of 0.8% which was projected to be at 0.3%. The ISM Manufacturing Price data has increased to 74.2 from the previous figure of 72.7 which was predicted to be at 70.5. Moreover, Fed Chair Powell is going to speak today about the short-term interest rates and future monetary policy that is expected to be quite hawkish in nature and US President Donald Trump is going to speak today, which might inject good amount of volatility in the market. As of the current scenario, USD is expected to gain further momentum in the coming days whereas AUD is projected to lose more grounds in the coming days until AUD comes up with positive economic reports to counter the impulsive bearish pressure.

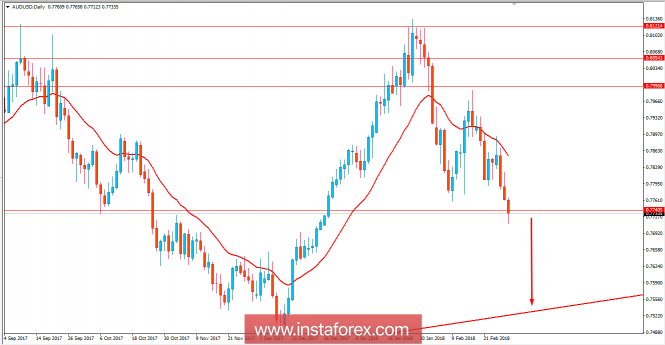

Now let us look at the technical view. The price is currently residing at the edge of breaking below the 0.7750 price area. The dynamic level of 20 EMA has been quite responsive to the price and expected to push the price much lower in the coming days. As the price remains below 0.7750 with a daily close today, further bearish pressure is expected to continue.

The material has been provided by InstaForex Company – www.instaforex.com