Fundamental Analysis of USD/JPY for January 23, 2018

USD/JPY has been quite volatile recently showing both impulsive bullish and bearish pressure below 111.00 area. Today JPY BOJ Policy Rate report was published unchanged as expected at -0.10% whereas All Industry Activity report showed a significant increase to 1.0% from the previous value of 0.3% which was expected to be at 0.9%. Moreover, in BOJ Press Conference the upcoming policies for improving the economy has been quite remarkable leading to further gain on the JPY side today. On the other hand, ahead of the Advance GDP report to be published on Friday, Today USD Richmond Manufacturing Index report is going to be published with a decrease to 19 from the previous figure of 20. As of the current scenario, USD has been struggling to provide good impactful economic data for which JPY having mixed economic reports lead to further bearish pressure in the pair. This week USD does not have any highly impactful economic event or report to recover its gains whereas JPY is expected to create more bearish pressure in the coming days.

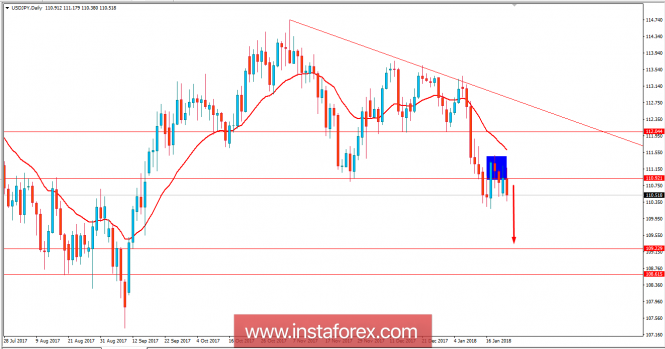

Now let us look at the technical view. The price is currently showing impulsive bearish pressure after an impulsive bullish pressure below 111.00 which made the market quite indecisive for few hours. The dynamic level of 20 EMA is expected to hold the price as resistance whereas the price remaining below 111.00 is expected to lead to further bearish pressure with the target towards 109.20 and later towards 108.50 support area in the coming days.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fundamental Analysis of USD/JPY for January 23, 2018