The fundamental weakness of the dollar

The US Federal Open Market Committee, fully in line with expectations, left the federal funds rate unchanged at 1.00%-1.25%. The final comment was subject to minor changes that did not change the overall meaning of the document, but the players saw signs of weakness in it, which ultimately led to a large-scale sale of the dollar across the entire spectrum of the market.

The first change relates to core inflation, in the new edition of the FOMC sees the risks of a lower level by the end of the year than before. As for the growth prospects for the rate, the FOMC announced the probability of its being below the expected long-term “some time” levels, which indicates a possible change in the rate forecasts at the next meeting in September. Both changes in the text are pigeon-like and contribute to the further sale of the US dollar.

Eurozone

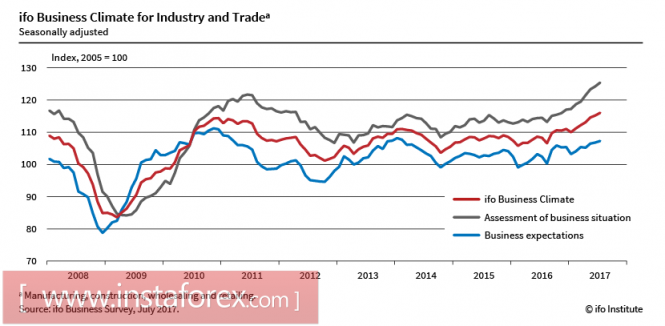

At the same time, signals coming from the eurozone are noticeably more positive. The index of business optimism from IFO rose in July to 116 p, setting a new record for the third month in a row, and the satisfaction of companies with the current business situation is the highest since the unification of Germany.

Record levels are observed in the construction and manufacturing sectors, a slight decrease in the retail sector did not affect the overall assessment.

The ECB is finding it increasingly difficult and more difficult to justify the stimulus policy against the backdrop of strong growth in optimism. Most of the key macroeconomic indicators of the eurozone show steady growth, which can not be said about statistics from overseas, where there is a further gap between overstated expectations and real data.

The euro remains the favorite pair with the dollar, despite a noticeable overbuying. In favor of a correction, technical factors can speak, and not fundamental, so any reduction will be used by players for new purchases.

United Kingdom

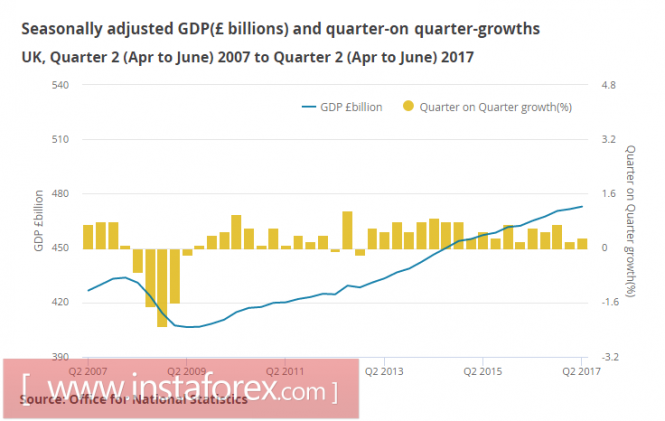

Preliminary data on UK GDP in the second quarter came in line with expectations, growth was at 0.3%, at an annual rate of 1.7%, and slightly below 2.0% a quarter earlier. But this does not indicate a failure in the economy, which investors feared very recently.

The pound continues to rise, primarily due to the currency’s excessive decline in the first six months after Brexit. As time has shown, the collapse of the British economy did not happen, and the pound returns to fundamentally grounded levels.

Oil and ruble

Oil prices are rising after the US Energy Ministry again reported a drop of 7.21 million barrels in the reserves, which eventually led to the lowest level of reserves since the beginning of the year.

Saudi Arabia’s efforts to reduce production among the OPEC countries led to the reduction of supplies announced by Kuwait, a little earlier about a 10% reduction reported by the United Arab Emirates.

Also it is necessary to note the ever more active signals from the US shale companies.

Halliburton has een announced that a number of drilling rigs have stopped, indicative of a reduction in investment.

On July 28, the Bank of Russia will hold a regular meeting. The probability of a pause in the rate reduction cycle has increased, as inflation in June increased from 4.1% to 4.4%, and inflation expectations failed to decline.

The ruble continues to move sideways at levels just below 60 rubles / dollar, and there are no reasons for expect sharp movements.

The material has been provided by InstaForex Company – www.instaforex.com