GBPUSD Daily Technical Outlook and Review. Wednesday 18th June

4 hour timeframe

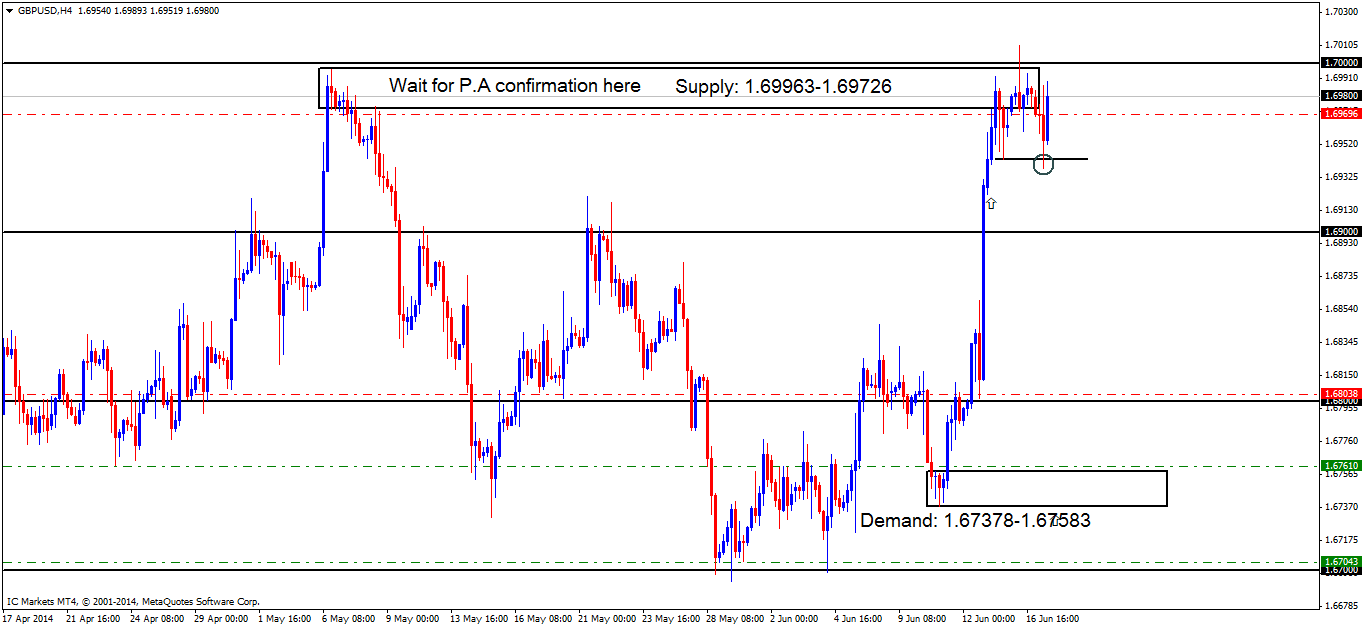

Price action on this timeframe looks a right mess at the moment, wicks and tails are seen in all directions. The sellers are yet to consume the ‘mini low’ at 1.69221 marked with an arrow, nevertheless, minor support seen at 1.69431 has been hit (marked with a circle), which appeared to slightly consume the buyers in and around this area.

Now, even with sellers attempting to consume buyers at the minor support area just mentioned above, this does not mean a pending sell order can now be placed where our current confirmation sell order is sitting. Sellers will have to try harder than that, and at least attempt to consume the ‘mini low’ mentioned above for a pending sell order to be allocated.

- Pending buy orders (Green line) are seen just above the round number 1.67000 at 1.67043, this area will likely see a reaction due to the amount of credible touches this level has seen, making it an area to watch out for.

- Pending buy orders (Green line) are seen at 1.67610 just above demand at 1.67378-1.67583. A pending order is valid here due to the momentum away from the demand area, indicating orders may be left unfilled here.

- P.A confirmation buy orders (Red line) are seen just above the round number 1.68000 at 1.68038. A reaction may be likely here because of the way pro money used this level to rally prices higher with force, a quick change in direction like this likely indicates pro money activity, thus, all of their orders may have not been filled at that time. The reason a pending order is not used here is because pro money, on a regular basis perform deep stop hunts around big figure levels (1.68000), and these tails/wicks can be huge sometimes, hence the need to wait for confirmation.

- No pending sell orders (green line) are seen in the current market environment.

- The P.A confirmation sell orders (Red line) set at 1.69696 just below supply at 1.69963-1.69726 still remains active. Price, however, still will need to convincingly consume buyers around the low (marked with an arrow) at 1.69221 below before a pending sell order is permitted.

GBPUSD 4hr Chart (click to enlarge)

- Areas to watch for buy orders: P.O: 1.67043 (SL: 1.66527 TP: [1] 1.68000 [3] 1.68708) 1.67610 (SL: 1.67345 TP: [1] 1.68000 [2] 1.69000 [likely to be changed, depending on price approach]). P.A.C: 1.68038 (SL: Dependent on approaching price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: No pending sell orders seen in the current market environment. P.A.C: (Active-awaiting confirmation) 1.69696 (SL: More than likely will be at 1.70030 TP: Dependent on approaching price action after the level has been confirmed).

- Most likely scenario: The likely scenario has not changed much from the last analysis. Price is likely still heading south from supply at 1.69963-1.69726, but we may see a lot of choppy price action before this materializes.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Source: IC Markets Trading Desk