USDCAD Monday 23rd June: Weekly technical outlook and review.

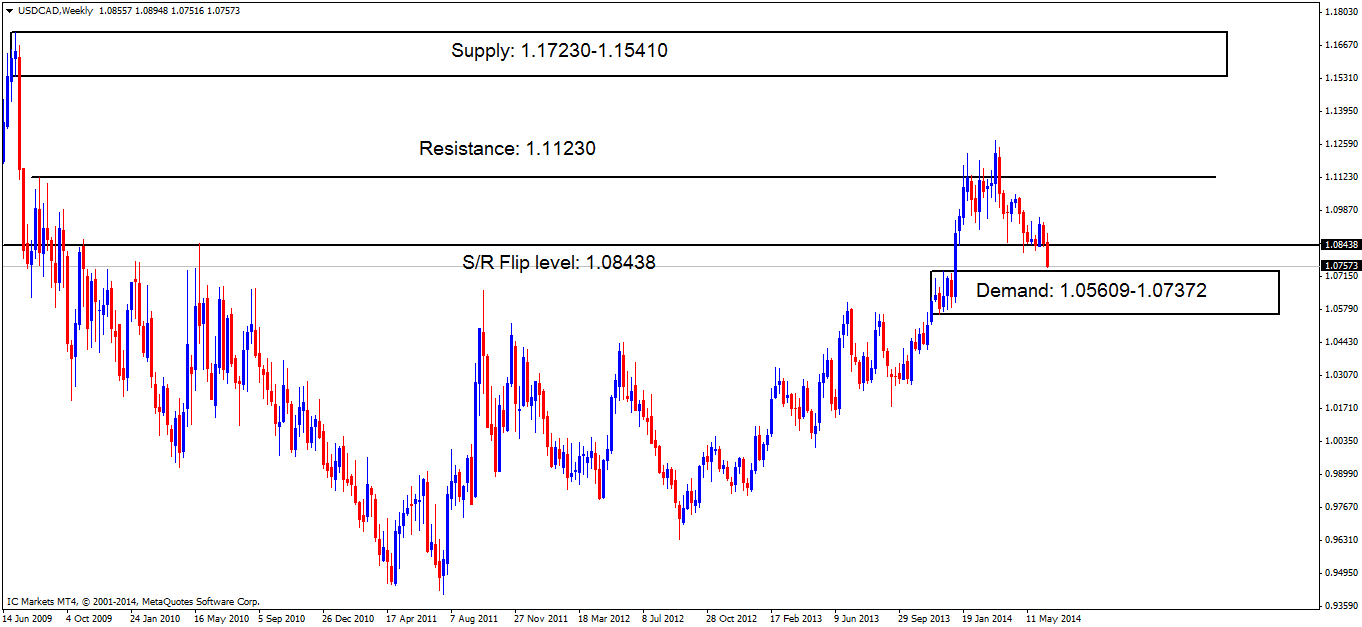

Wow! Sellers were well and truly in control last week, breaking the S/R flip level support at 1.08438, and closing just above weekly demand (1.05609-1.07372) at 1.07573.

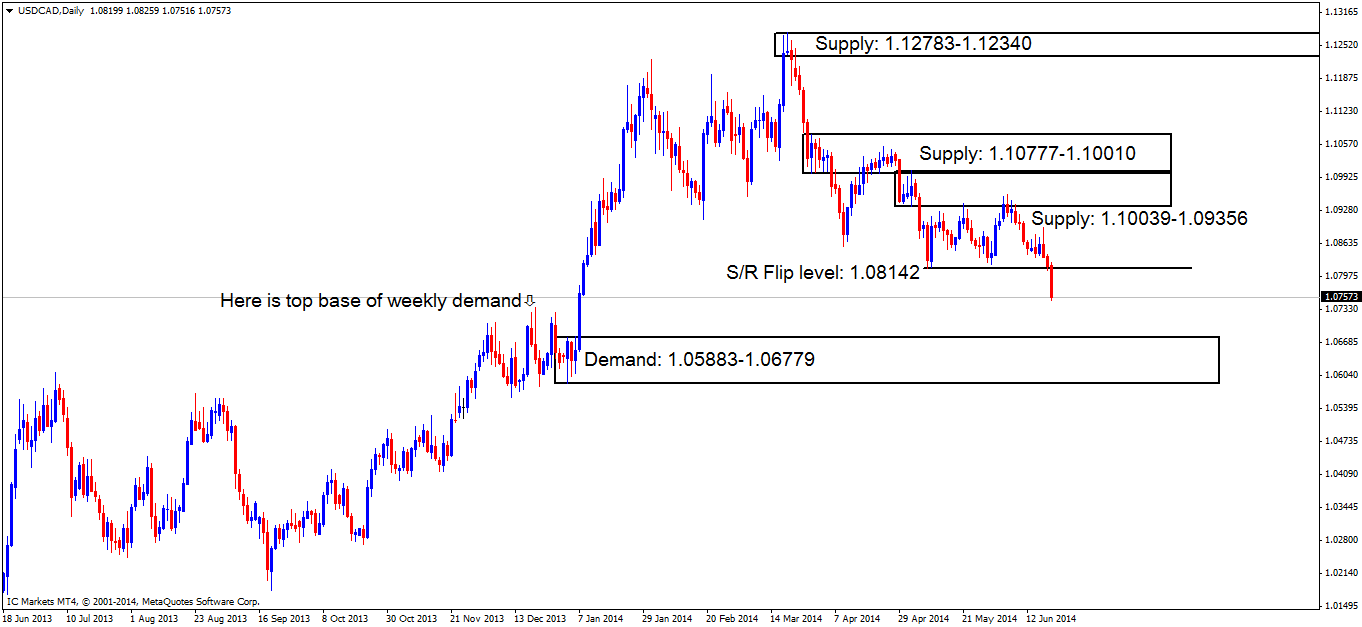

Daily TF.

The daily timeframe shows sellers broke minor support at 1.08142 and closed below this area with a full-bodied bearish candle. A retest of this area may be seen before a likely drop to the downside towards demand at 1.05883-1.06779 happens.

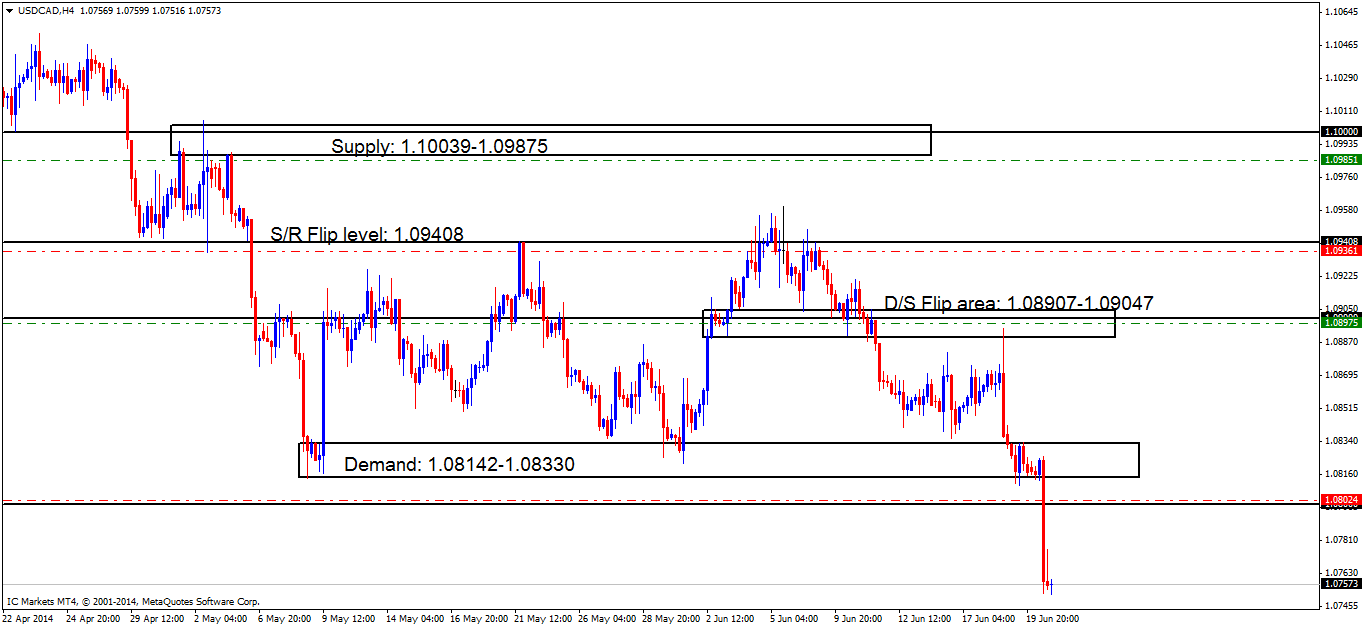

4hr TF.

Chart 1 below shows there was no hope for any of the buyers around the round number 1.08000.

Chart 1:

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- The P.A confirmation buy orders (Red line) set just above the round number 1.08000 at 1.08024 has been cancelled. Price dropped too far from the confirmation entry level, and buyers made no attempt to push prices higher.

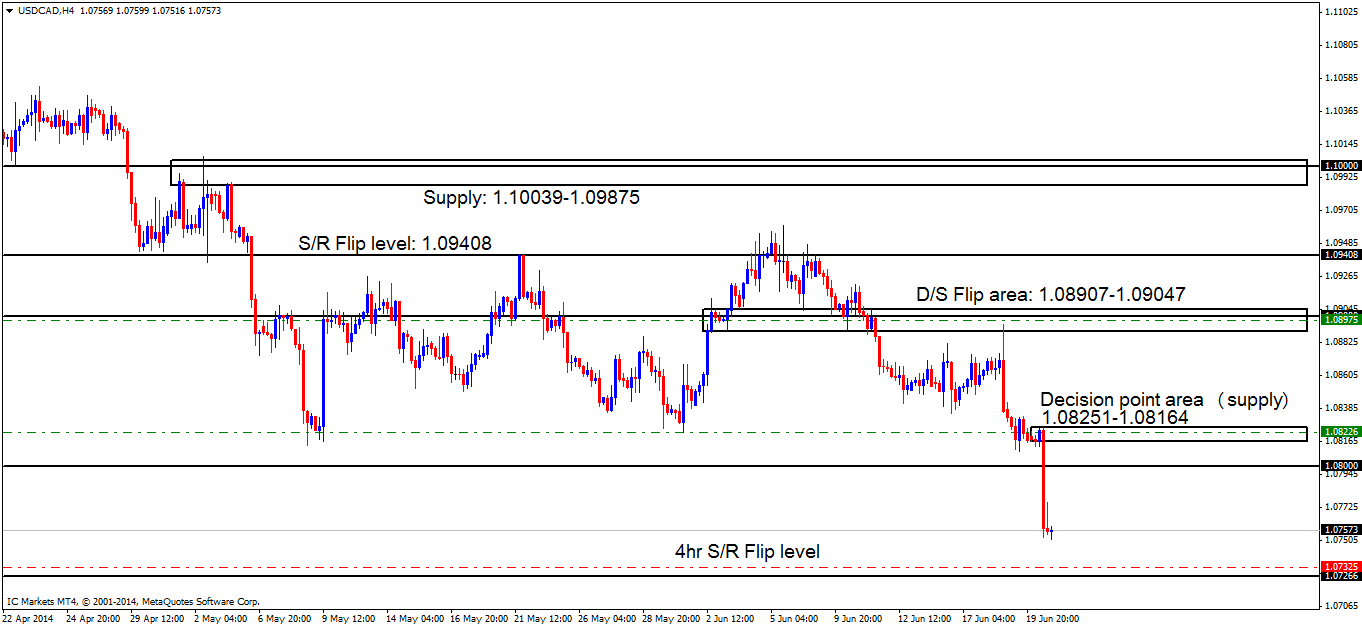

- New P.A confirmation buy orders (Red line) set just above the S/R flip level (1.07266) at 1.07325. A pending order set here would be dangerous due to there being no logical area to place one’s stop-loss order.

- The pending sell order (Green line) set just below supply (1.10039-1.09875) at 1.09851 has been removed, since price moved too far away from the entry level.

- Pending sell orders (Green line) are seen at 1.08975, within supply (1.08907-1.09047) just below the round number 1.09000. A pending sell order is permitted to be set here since the sellers confirmed this area from the previous confirmation sell order that was originally set at 1.08876 by consuming the majority of the buyers situated in and around demand below at 1.08142-1.08330 (Seen on Thursday 19th June daily analysis).

- New pending sell orders (Green line) are seen within the decision point supply area (1.08251-1.08164) at 1.08226. Pending orders are valid here due this likely being the work of pro money, the momentum out of the zone is only caused by traders with big accounts, and when pro money move the market, all of their orders here were unlikely to have been filled, hence a pending order being logical here.

- The P.A confirmation sell order (Red line) set just below the S/R flip level (1.09408) at 1.09361has been removed, since price moved too far away from the entry level.

Chart 2 below shows the alterations which have had to be made. A new decision point area (supply) is seen at 1.08251-1.08164 has formed; this is an important area of interest as this is where pro money made the ‘decision’ to push price down hard.

The 4hr S/R flip level seen at 1.07266 is around the base of weekly demand at 1.05609-1.07372 (see on the weekly chart), meaning this area is definitely one to watch during the week!

Quick Recap:

On the weekly timeframe, price is currently heading south towards weekly demand (1.05609-1.07372), whilst on the daily timeframe a minor support level (1.08142) has seen a break south. The 4hr timeframe shows near-term demand (S/R flip level… 1.07266) level where we have a confirmation buy order set at 1.07325, while near-term supply is seen above at 1.08251-1.08164 where we have a pending sell order set within at 1.08226.

- Areas to watch for buy orders: P.O: There are no pending buy orders seen within the current market environment. P.A.C: 1.07325 SL: Dependent on approaching price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O:1.08975 (SL: 1.09059 TP: 1.08330 [May change if any new developments in the market are seen]) 1.08226 (SL: 1.08357 TP: Dependent on approaching price action) P.A.C: There are no P.A confirmation sell orders seen within the current market environment.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Sources: IC Markets Trading Desk