Ichimoku cloud indicator analysis of USDX for January 18, 2018

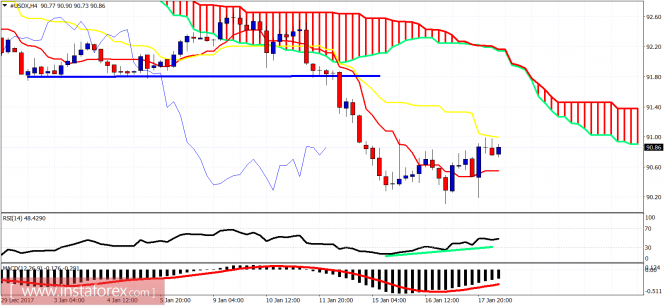

The Dollar index bounced yesterday, but price remains below the 4-hour kijun-sen. For a bigger bounce to come, we should see a break above yesterday highs. Trend remains bearish but with some reversal warnings.

Blue line – resistance

The Dollar index is challenging the kijun-sen. Trend is bearish as price is below the 4-hour Ichimoku cloud. Support is at 90.19 and resistance at 91. Breaking above the resistance will push price towards 91.80. Breaking below support will push price towards 89.50.

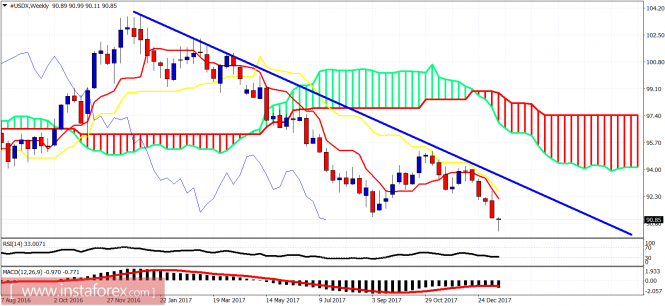

Blue line – long-term resistance

The Dollar index is in a weekly bearish trend. The weekly candle so far is shaping up to be a bullish reversal hammer. We have to more trading sessions including today so traders need to be patient and see where the week closes. A weekly close above 90.80 would be a bullish sign. A weekly close near or below 90.30 will be a bearish sign.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Ichimoku cloud indicator analysis of USDX for January 18, 2018