Intraday Analysis 7th June 2018

Eurozone revised GDP to remain unchanged

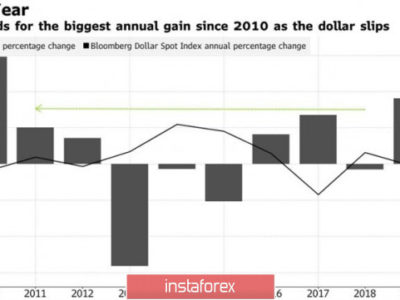

The U.S. dollar was seen easing back from the gains on Wednesday with not much of data. Australian GDP was seen rising 1.0% which was better than the expected print of 0.9%. The fourth quarter GDP data was also seen revised slightly higher to 0.5%.

Swiss inflation report was seen rising 0.4% which was higher than the forecasts of 0.3% and showed acceleration from 0.2%. Data from Canada showed that building permits fell 4.6%. This was higher than the forecasts of a 1.0% decline. The previous month’s data was revised down to 1.3%.

In the U.S. the revised nonfarm productivity was seen rising 0.4% on the quarter.

Looking ahead, the Eurozone GDP figures will be released. The revised GDP numbers are expected to show 0.4% on the quarter, unchanged from the previous estimate.

Later in the day, the BoC Gov. Poloz is expected to speak.

EURUSD intra-day analysis

EURUSD (1.1789): The EURUSD currency pair was posting gains on Wednesday as price action breached the resistance level of 1.1730. The currency pair is on track to test the next main resistance level at 1.1846 – 1.1824 level. However, we expect to see a pullback in price action as the breached resistance level of 1.1730 is likely to be established as support. A rebound off the 1.1730 level could signal the start of a recovery in the EURUSD currency pair. However, a breakout above 1.1846 is needed in order to confirm the upside toward 1.2232 resistance level.

USDJPY intra-day analysis

USDJPY (109.96): The USDJPY currency pair attempted to rise to highs near 110.26 before the U.S. dollar gave up some of the gains. We expect the minor declines to push the currency pair back to the 109.57 – 109.43 level of support which was previously tested. As long as the support holds, USDJPY could be seen targeting the next main resistance of 110.62. However, in the event that the currency pair fails to hold the support level, further declines could push USDJPY lower toward 108.90.

XAUUSD intra-day analysis

XAUUSD (1296.92): Gold prices continue to post the consolidation below the 1304 – 1301 level of resistance. Price action managed to break the outer trend line of the falling price channel. We expect the consolidation to continue but there could be a strong chance that the precious metal could breach the resistance level. A breakout above 1304 could signal gold prices rallying higher toward the 1325 level of resistance. To the downside, failure to break the resistance level could keep gold prices hovering lower toward the 1282 support.