NZD Analysis – 7th of June

The NZD bearish bias has diminished since the Financial Stability Report, however in the longer-term, the RBNZ are still expected to cut again. Prior to the FSR the market was expecting with 85% probability that the Bank will cut on June 9. These chances have now diminished to roughly 50%, but we believe the true chances are actually lower, given that the RBNZ have already cut rates five times in the last 18 months and have expressed serious concerns over rising real estate prices. We expect Kiwi to trade relatively in line with commodities for the coming weeks, without any significant monetary policy-based sentiment.

NZD Analysis

Interest Rate

Official Cash Rate: 2.25%

Last Change: March 10, 2016 (2.50%)

Expected Future Change: 60% chance of a cut

Next decision: June 9

Inflation

Inflation Target: 2% (1-3%)

Period: Year ending March 31

CPI: 0.4% Prior: 0.1%

Core: 0.7% Prior: 0.5%

Next Release: July 17

Employment

Period: Q1

Employment Growth: 1.2% Expected: 0.7%

Unemployment Rate: 5.7% Expected: 5.5%

Labour Cost Index: 0.4% Expected: 0.3%

Next Release: August 4

Growth

Period: Q4

GDP: 0.90% Expected: 0.70%

Next Release: June 15

Global Dairy Trade Price Index

GDT Price Index: 3.4%

Next Release: June 15

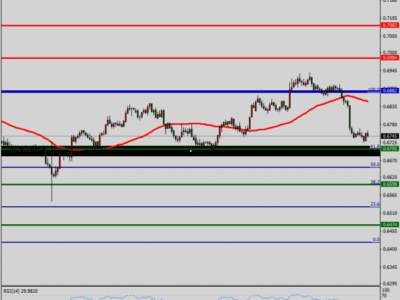

NZDUSD traded in a 350-pip range throughout April, May, and early June. The pair made a double-top in early May and then declined alongside the Aussie. Price action since mid-May has been relatively mixed as the market continues to reprice lower chances of a June cut due the concerns held by the RBNZ of stimulating the overheating housing market. Expectations of a June cut have now declined to roughly 50%.

Kiwi saw a rally across the board on May 11 when the RBNZ released their biannual Financial Stability Report. The report did not introduce any new macroprudential measures to combat the overheating housing market in Auckland. The omission of any new measures to slow rising house prices means the Bank is unlikely to cut rates further in June, given that this will clearly exacerbate the problem and add to financial risks to the economy. The Bank had already cut rates at total of 125 basis points during the prior year and a half; they are now likely to remain on hold for sometime, their easing bias impeded by real estate inflation.

On May 18, the Producer Price Index for the first quarter missed estimates; Inputs, which measures the change in the price of goods and raw materials purchased by manufacturers, declined -1.0%, below the 0.3% expected rise, but less than the prior decline of -1.2%. Outputs, which measures the change in the price of goods sold by manufacturers, declined -0.2%, below expected rise of 0.4%, but above the prior decline of -0.8% for the fourth quarter of 2015. Again, inflation measures remain extremely low in New Zealand, but nevertheless a slight improvement from prior.

May 17 saw the RBNZ release their Inflation Expectations survey. The two-year outlook edged up to 1.64%, from a prior reading of 1.63%, which was a 22-year low. One-year expectations rose to 1.22% from 1.09% in the first quarter. The marginal improvement lessens the chance of RBNZ action on June 9.

The latest Global Dairy Trade auction, held June 1, saw the price index rise 3.4% since a fortnight prior – an improvement from the prior fortnightly print of 2.6%. The Whole Milk Powder price index however declined by 1.7%. Overall dairy prices have been relatively mixed over recent auctions, a more sustained rise in prices will be needed before the market and RBNZ become more optimistic about the outlook.

The post NZD Analysis – 7th of June appeared first on Jarratt Davis.

Source:: NZD Analysis – 7th of June