The Return Of The Dollar Bulls

The greenback is showing signs of a possible Bullish Swing.

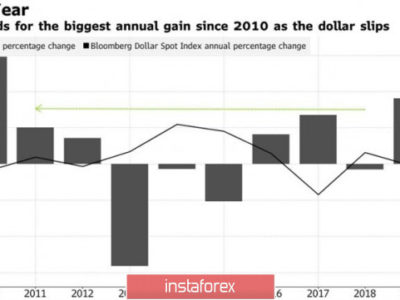

The Dollar Index (DXY) dropped significantly following the FED Rate Hike and FOMC press Conference. Due to that, metals and most majors thrived and enjoyed the fresh air brought by the weakness in the dollar.

However, the Bullish Swings seen on XAU, XAG & EUR do not seem to fit properly in an Impulse, showing overlaps and Bearish Patterns.

Will the dollar continue its weakness or turn green?

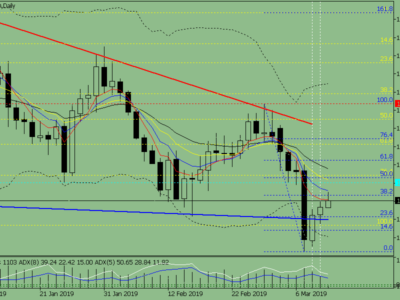

Technicals are pointing towards a possible Bullish Rally of the dollar and completion of the bigger structures.

DXY – 2H Chart

Reasons in favor of a Bullish Dollar:

- Double Three Structure in Minutes WXY (pink)

- Expanding Flat & Zig-Zag Patterns appear to be complete and honoring the Fibonacci measurements

- Possible Bullish breach of the Descending Channel and a probability of a Support

- Harmonic Pattern present – Bullish Gartley

XAU/USD – 2H Chart

XAG/USD – 2H Chart

EUR/USD – 2H Chart

GBP/USD – 2H Chart

*The present analysis is to be treated as simple market commentary and not as investment advice or as a solicitation to trade. Please be aware of the real risk involved when trading financial instruments.

Many pips ahead,