Risk aversion weighs on markets, yen firms

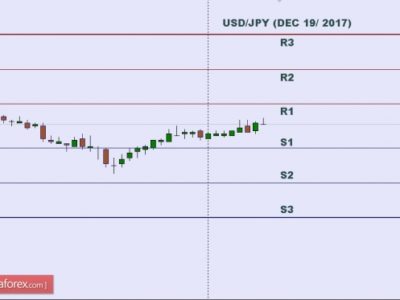

Risk aversion was back in the markets as investors continued to struggle with uncertainty over the timing of the next U.S. interest-rate increase. Shares across Asia slid Tuesday as prices of oil and other commodities fell. The yen strengthened versus the U.S. dollar overnight. Brent crude oil was recently down 0.4% at $48.13 per barrel.

Japan’s Nikkei Stock Average sank 0.7%, South Korea’s Kospi lost 0.6%, and Australia’s S&P/ASX 200 retreated 0.2%. In China, the Shanghai Composite Index was off 1%. Hong Kong’s Hang Seng Index slid 0.1%.

Many investors remained skeptical the U.S. Federal Reserve will raise short-term interest rates as soon as June, eve after hawkish by three Fed officials overnight. A prevailing reluctance to make big bets before the Fed’s policy meeting next month has kept trading quiet in Asia.

Hawkish meeting minutes from the Federal Reserve last week pushed the current two-year U.S. Treasury note yield briefly above 0.90 per cent, as bond traders assigned higher odds of a rise in official borrowing costs in June.

After the fireworks, the two-year note, a barometer of Fed policy expectations still remains below its peak of 1 per cent seen in mid-December when the central bank raised borrowing costs. A similar rise in mid-March was swiftly sunk after the Fed doused tightening expectations due to the febrile market environment.

Against a backdrop of mixed US economic data and the ever present risk of global financial volatility, the bond market remains confident of calling the bluff of policymakers.

The post Risk aversion weighs on markets, yen firms appeared first on FXTM Blog.