Short-term Trading Idea: FX USD/CAD – Bull Speculation: Expected Growth to 1.3288 – 1.3397 Zone

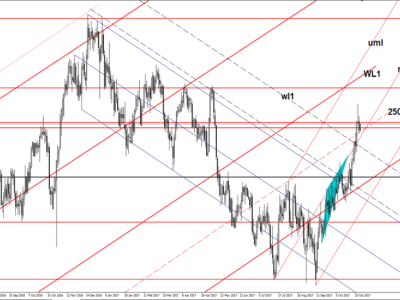

Trading opportunities for currency pair: After the UK referendum, the USDCAD tested the solidity of the trend line. The target zone is 1.3288 – 1.3397. The upper line of channel one passes through it. We just need to wait for the price to strengthen above channel 2 and the trend line. Growth to cancel with a close of the day”s candle below 1.2654. Putting a stop above here would be useless.

Previous

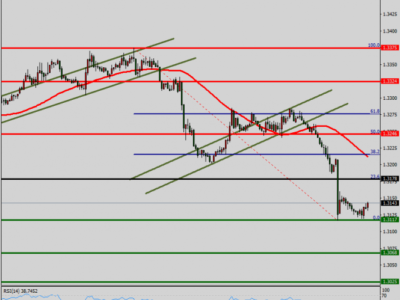

The last idea I did for the Canadian was on 22nd June, 2015. Back then the USD/CAD rate was at 1.2269. After a bounce from the 61.8% level, a hammer or a pinbar (whichever you prefer) formed on the daily. As soon as the price strengthened above 1.2250, an inverted candle formation began to work off. The first target was at 1.2472 (trend line) and the second was at 1.2666 (idea from 1st June). Both targets were reached by 7th July. On 29th September, the USDCAD had lifted to 1.3457.

Current Situation

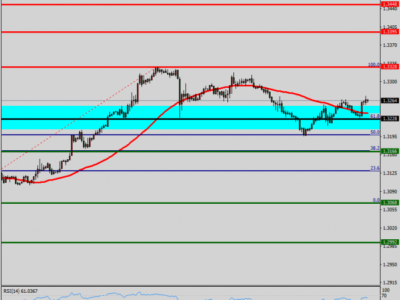

After the UK referendum, oil fell and the USD rose. The USD/CAD tried to pass the trend line. A piercing has been fixed for the moment. The market closed at the line.

What”s interesting about this pair? After a break in the trend line, the buyers will have the road to 1.3377 open. A deep correction will see the target at around 1.3856.

Now to the calculation levels. The horizontal 1.3288, 1.3996 and 1.3837 levels are interim ones. They have a geometrical basis. The final result is displayed on the graph.

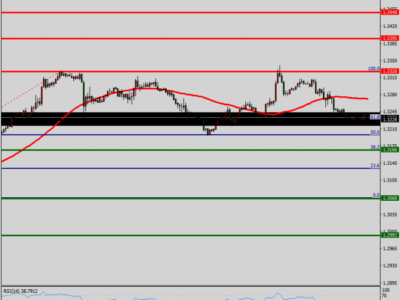

From a 1.2461 minimum, two arcs have been built. The first is completed at 38.2% – 1.3313 from the fall from 1.4690 to 1.2461. The second is at the 50% level: 1.3577.

The second set of arcs is an expansion of the Fibonacci levels. They are built from 1.2461 – 1.3188 – 1.2654. On this basis I”ve got two 100% levels from the 1.2461 to 1.3188 wave and 161.8%. The first is 1.3397 and the second is 1.3856.

The third pair of arcs is an expansion of the Fibonacci levels which are built along 1.2654 – 1.3086 – 1.2768. The 100% level is 1.3103 and the 161.8% is 1.3377.

Now let”s take a look at how the levels have built up. In my case, it”s the 1.3288 – 1.3397 zone. The upper line of channel one passes through here. In Asia the dollar is strengthening. We just need to wait for the price to strengthen above channel two and the trend line.

Growth to cancel with a close of the day”s candle below 1.2654. Putting a stop above here would be useless.

Why not take advantage of the improved version of the Trader”s Calculator.

Calculate swaps and costs of points >>>

Source:: Short-term Trading Idea: FX USD/CAD – Bull Speculation: Expected Growth to 1.3288 – 1.3397 Zone