Technical analysis of GBP/JPY for March 20, 2017

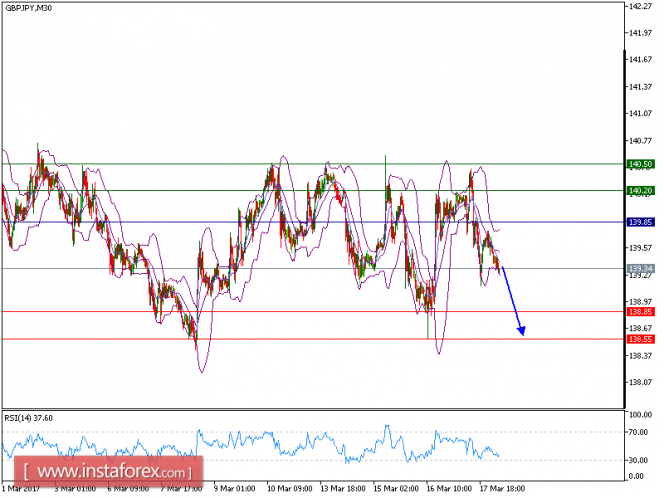

GBP/JPY is under pressure. The pair remains capped by its descending 20-period moving average, which is still below the 50-period moving average. Meanwhile, the relative strength index stays below its neutrality area at 50 and lacks upward momentum. The intraday trend remains down.

As long as 139.85 holds as the key resistance, expect a break below the nearest support at 138.85 at first. A break below 138.85 allows for the further drop to 138.55 as likely.

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 138.85. A break below this target will move the pair further downwards to 138.55. The pivot point stands at 139.85. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 140.20 and the second one at 140.50.

Resistance levels: 140.20, 140.50, and 140.95

Support levels: 138.85,138.55, and 138.00

The material has been provided by InstaForex Company – www.instaforex.com