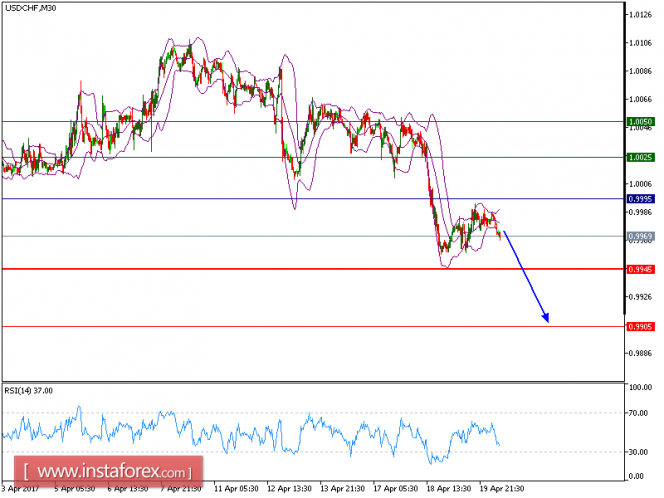

Technical analysis of USD/CHF for April 20, 2017

USD/CHF is under pressure as the key resistance is at 1.0005. Although the pair posted a rebound, it is still trading below its key resistance at 1.0005 (the low of April 17), which should limited the upside potential. Even though a continuation of technical rebound cannot be ruled out, its extent should be limited.

As demand for haven assets cooled down, U.S. government bonds retreated following the biggest one-day price rally in more than a month on Tuesday. The benchmark 10-year U.S. Treasury yield rose to 2.202% from 2.177%. The U.S. dollar rebounded against the euro, Japanese yen and British pound, sending the ICE U.S. Dollar Index up 0.3% to 99.80 and saving it from losing its 200-day moving average (at 99.42).

Hence, as long as 0.9995 holds on the upside, look for a further decline to 0.9945 and even to 0.9905 in extension.

Resistance levels: 1.0025, 1.0050, and 1.0085

Support levels: 0.9945, 0.9905, and 0.9860

The material has been provided by InstaForex Company – www.instaforex.com