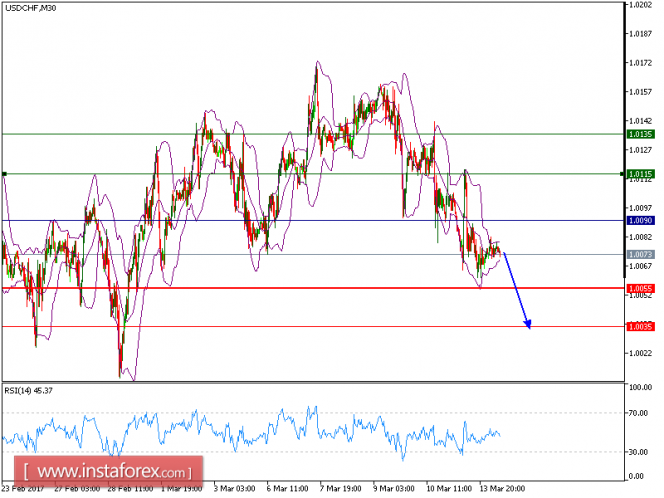

Technical analysis of USD/CHF for March 14, 2017

USD/CHF is expected to trade with a bearish outlook as the key resistance at 1.0090. The pair is under pressure below the key resistance at 1.0090 (the low of March 9), which should limit the upside potential. The declining 50-period moving average suggests that the price still has potential for a further drop. The relative strength index is around its neutrality level at 50 and lacks upward momentum.

The U.S. dollar wavered as investors became cautious ahead of a series of central bank and political events scheduled for the week. Apart from the Fed’s meeting which is widely expected to result in an interest rate rise, the Bank of Japan, the Bank of England, and Norges Bank will also hold their policy meetings. The closely-watched election is due in the Netherlands. Besides, Group of 20 finance ministers will meet in Germany on March 17-18.

Therefore, as long as 1.0090 holds on the upside, look for a new drop to 1.0055 and even to 1.0035 in extension.

Resistance levels: 1.0115, 1.0135, and 1.0160

Support levels: 1.0055, 1.0035, and 1.00

The material has been provided by InstaForex Company – www.instaforex.com