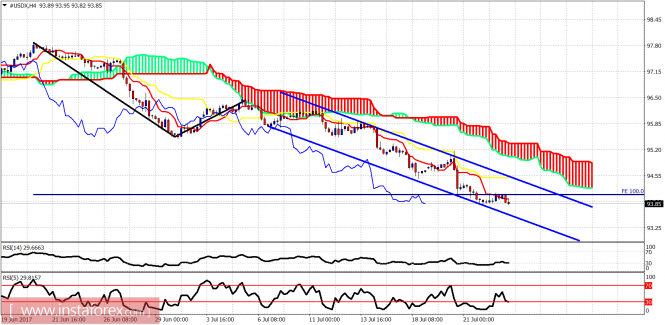

Technical analysis of USDX for July 25, 2017

The Dollar index remains in a bearish trend. No reversal signal yet, although we have some warning signs as oscillators get oversold. The key support area for the long-term is at 92-93.

Blue lines – bearish channel

The Dollar index is clearly in a bearish trend making lower lows and lower highs. Price remains inside the bearish channel and below both the tenkan- and kijun-sen indicators on the 4-hour chart. Short-term support is at 93.50 and resistance is at 94.50.

Green rectangle – long-term support area

The Dollar index has broken below the weekly Kumo (cloud) and is heading towards the green rectangle support area where it could also find support at the 200 MA currently at 92.35. Oscillators are oversold. It is just a warning to be cautious.

The material has been provided by InstaForex Company – www.instaforex.com