Thursday 16th April: European Open Briefing

Global Markets:

- Asian stock markets: Nikkei down 0.50 %, Shanghai Composite gained 2.00 %, Hang Seng rose 0.30 %, ASX up 0.60 %

- Commodities: Gold at $1204.70 (+0.30 %), Silver at $16.38 (+0.60 %), WTI Oil at $56.12 (-0.50 %), Brent Oil at $62.80 (-0.10 %)

- Rates: US 10 year yield at 1.897, UK 10 year yield at 1.548, German 10 year yield at 0.106

News & Data:

- Australia Employment Change 37.7k, Expected: 15k, Previous: 41.9k

- Australia Unemployment Rate 6.1 %, Expected: 6.3 %, Previous: 6.2 %

- Australia Participation Rate 64.8 %, Expected: 64.6 %, Previous: 64.7 %

- Australia MI Inflation Expectations 3.4 %, Previous: 3.2 %

- New Zealand Business PMI 54.5, Previous: 56.1

- UK RICS House Price Balance 21 %, Expected: 15 %, Previous: 15 %

- China FDI 11.3 %, Previous: 17.0 %

- Australian Treasurer Hockey: Australia’s Credit Rating Not Under Pressure — BBG

- Fed’s Lacker: Short-Term Interest Rates Ought To Be Higher Right Now — BBG

- Fed’s Lacker: Strong Case For June Hike — BBG

- New Zealand FinMin English: NZ Has Sustainably Growing Economy, Will Navigate Lower Dairy Prices — BBG

Markets Update:

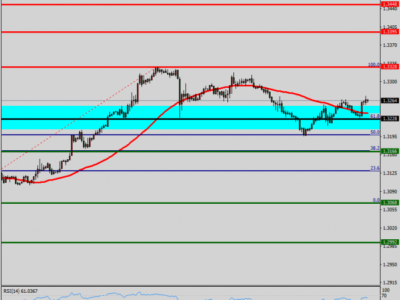

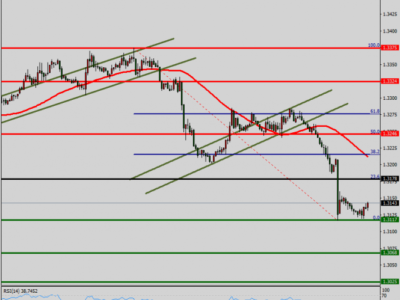

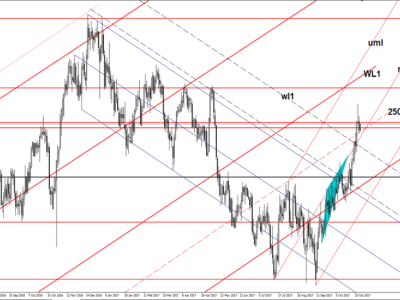

The Australian Dollar rallied overnight after better than expected employment data. The economy added 37.700 jobs vs 15.000 expected and the unemployment rate declined to 6.1 % vs expectations of 6.3 %. The market sees the chance of a RBA rate cut in May at 56 % vs 71 % prior to the employment data release. AUD/USD extended gains up to 0.7780, while AUD/NZD is now back above the 1.02 level. Broad USD weakness also pushed EUR/USD and GBP/USD to fresh highs, at 1.0740 and 1.4880 respectively.

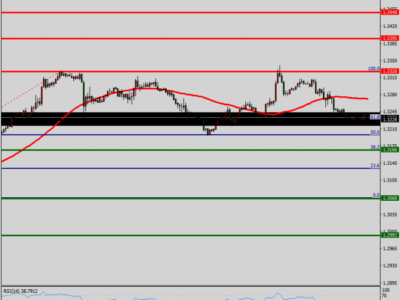

The Dollar is under pressure after another bad data print yesterday (Industrial Production). US economic data has been quite disappointing in the past few weeks and USD longs are getting slightly nervous. Meanwhile, there were no surprises from the ECB yesterday. They kept all rates unchanged, as expected, and comments from President Draghi were in line with the previous ones. USD/CAD declined sharply after the Bank of Canada was less dovish than anticipated. The pair broke below the important 1.2380-1.24 support area and stops in large size were cleared on the way down to 1.2280. USD/CAD posted fresh multi-week lows overnight, with 1.2250 the session low.

Upcoming Events:

- 08:15 BST – Swiss PPI (0.1 % m/m)

- 09:00 BST – Italian Trade Balance (€1.21bln)

- 13:30 BST – US Building Permits (1.08mln)

- 13:30 BST – US Housing Starts (1.04mln)

- 13:30 BST – US Initial Jobless Claims

- 15:00 BST – US Philadelphia Fed Manufacturing Index (6.3)

The post Thursday 16th April: European Open Briefing appeared first on .