Trading Outlook – Neutral

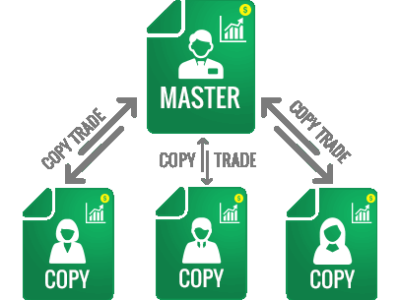

Click here to learn how to use my trade calls!

Originally updated: 07:30

Trading Bias: Not applicable

Currency pair: None

Current Sentiment: Neutral

At this stage of today’s session I will be awaiting news flow to provide opportunities to get into the market.

Fundamentals:

Overnight, price action was relatively choppy, Yellen had a speech but avoided any commentary regarding monetary policy. USD price action was largely dictated by the Dollar index amid a lack of risk appetite ahead of this week’s key risk events. The USD swung between gains and losses as participants await today’s US ADP a prelude to Fridays all important NFP report, Australian GDP came out relatively as expected (Y/Y 2.5% vs. Exp. 2.5% and Q/Q revised higher) which supported the AUD but was unable to hold on to its gains as we got unscheduled commentary from RBA’s Edwards who talked the currency down.

On today’s calendar we have US ADP at 1:15pm London time we will be looking for a positive figure here to get the markets speculating about Fridays NFP, look to match this data point up with the BoC’s rate statement at 3pm, the likelihood is that the BoC will keep rates unchanged and retain a dovish tone which will weigh on the currency.

On the CAD Bear in mind that yesterday we had a positive GDP reading from Canada which supported the CAD and last week’s comments from Poloz regarding observing the effects of a rate cut before adding additional cuts also supported the CAD. We know the BoC will want to avoid the CAD gaining too much support and therefore can expect a dovish tone from the BoC, one thing to look out for is that they might cut rates bearing in mind it is not a policy of the BoC to provide forward guidance therefore there is some chatter amongst economists that a rate cut could be in the offing – something to watch out for, if we do get a surprise announcement we can consider getting straight in on USD/CAD as most of the market is not expecting action and therefore moves will be pronounced.

Technicals:

Given the lack of immediate set ups available at this stage of the session the pairs and levels I will be looking out for that are in line with the fundamentals are;

Short – AUD/USD 0.7890

Short – EUR/USD 1.1200

Long – USD/CHF 0.9585

As always keep an eye on intraday news that may affect the outlook on these positions.

Other Market Moving News:

The Reserve bank of India surprised the market by cutting rates overnight in an effort to bring their inflation rate to the mid-point of their targeted 2% – 6% band.

To get daily market insights from Jarratt Davis delivered to your inbox simply enter your name and email below:

The post Trading Outlook – Neutral appeared first on Jarratt Davis.

Source:: Trading Outlook – Neutral