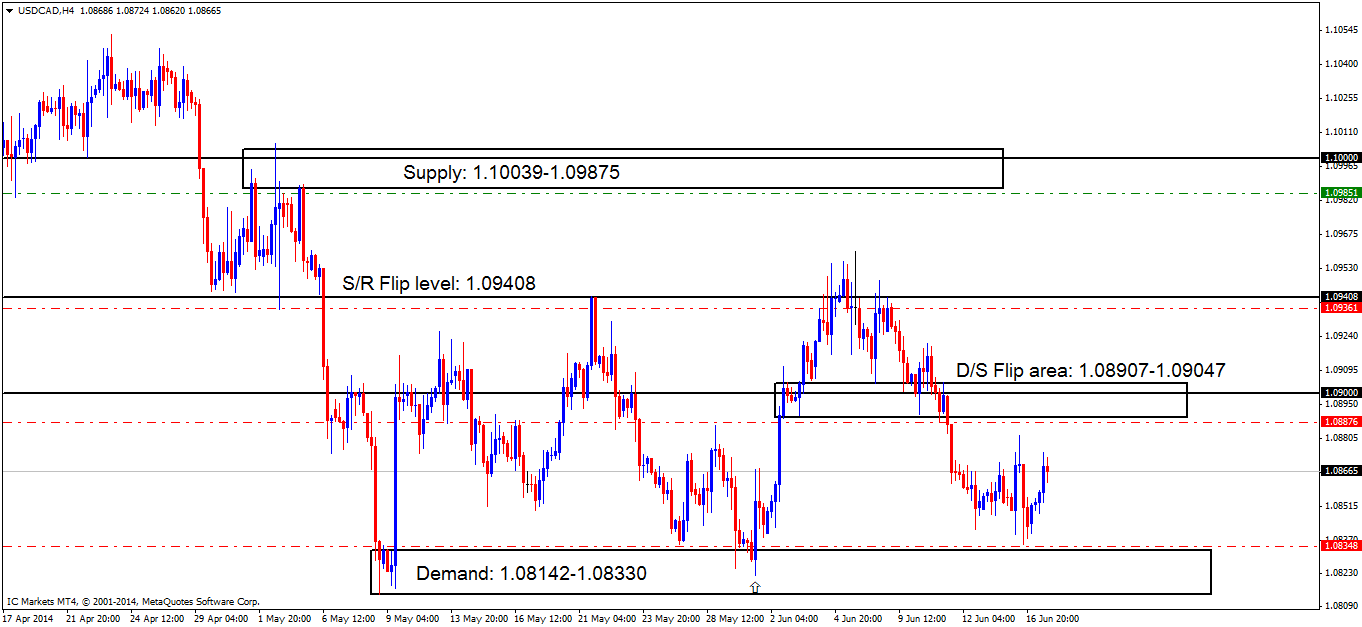

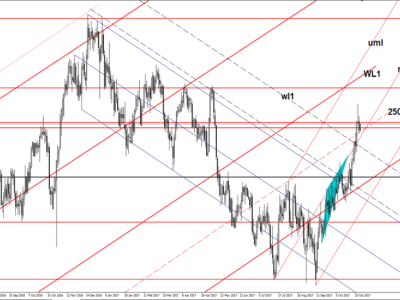

USDCAD Daily Technical Outlook and Review. Wednesday 18th June

On the 4hr chart technically, not much has changed since the last analysis. Price is currently seen trading between supply at 1.08907-1.09047 and demand below at 1.08142-1.08330.

The higher timeframes are indicating higher prices are likely to be seen, as the weekly timeframe is presently trading around support at 1.08438, and the daily timeframe showing price trading around minor support at 1.08142. Therefore, the 4hr supply (levels above) is likely to be breached before the demand area below (levels above) is.

It would be a shame if price were not able to drop to our confirmation buy order set at 1.08348 before any rally took place. This is something we should all remember as traders, and it comes in the form of four little words: We don’t chase price!

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) seen just above demand (1.08142-1.08330) at 1.08348. There may be orders left unfilled here, however, a pending order is not wise due to how deep price penetrated the level before (marked with an arrow).

- Pending sell orders (Green line) just below supply (1.10039-1.09875) at 1.09851 will very likely see a nice reaction. However, we should remain aware of the big figure number 1.10000 lurking within the top half of the supply area (levels above), so a bigger stop may be necessary.

- P.A confirmation sell orders (Red line) are seen just below the S/R flip level (1.09408) at 1.09361. A P.A.C order was selected here because of the deep wicks seen in and around this area, possibly indicating sellers have been consumed, thus weakening the level on return, and also not forgetting we are currently in higher –timeframe demand (weekly:1.08438 daily: 1.08142).

- P.A confirmation sell orders (Red line) are seen just below the D/S flip area (1.08907-1.09047) at 1.08876. Pending orders are not logical here since price could very well spike north, deep into the zone, attempting to penetrate the round number 1.09000 which could possibly stop us out if we had pending orders set, and also not forgetting we are currently in higher –timeframe demand (weekly:1.08438 daily: 1.08142).

USDCAD 4hr Chart (click to enlarge)

- Areas to watch for buy orders: P.O: There are no pending buy orders seen in the current market environment. P.A.C: 1.08348 (SL: Likely to be set at 1.08127 TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 1.09851 (SL: 1.10114 TP: [1] 1.09408 [2] 1.09047) P.A.C: 1.09361 (SL likely to be set at 1.09513 TP: Dependent on approaching price action after the level has been confirmed) 0.08876 (SL: Dependent on approaching price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Most likely scenario: Price will likely trade within where price is currently capped (supply 1.08907-1.09047 demand 1.08142-1.08330) during the low-volume sessions, once volatility picks up, the supply area (levels above) will likely break before the demand area (levels above) seen below does.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Source: IC Markets Trading Desk