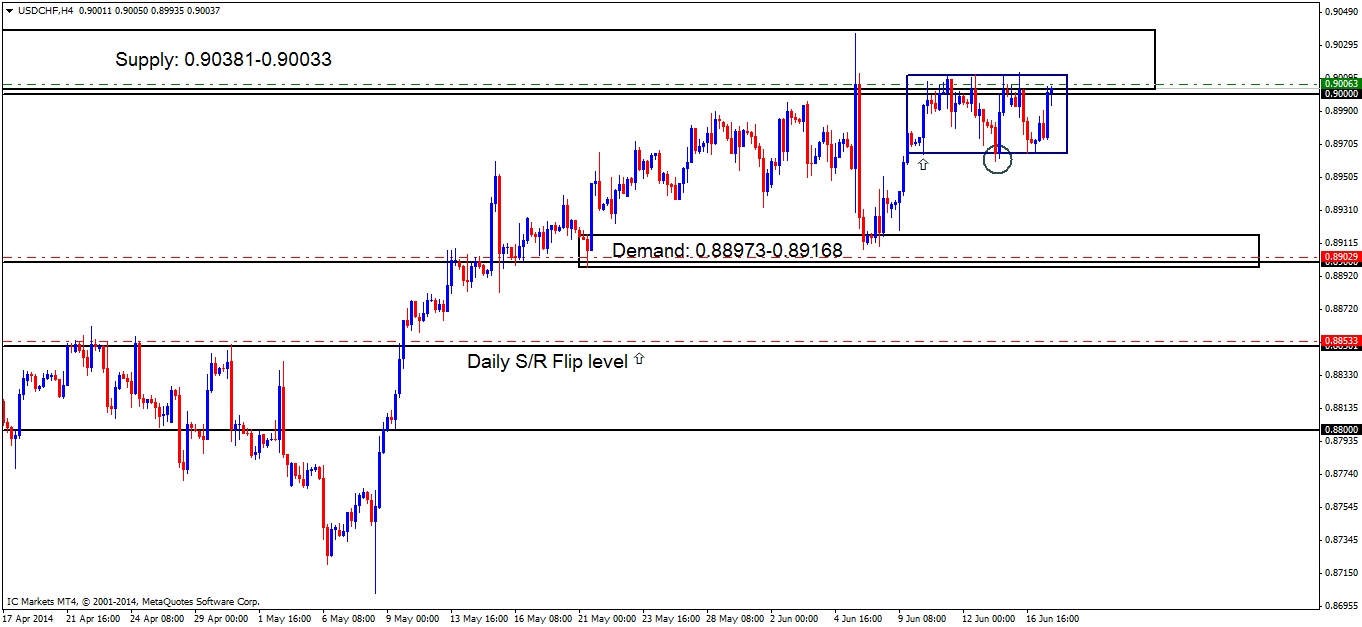

USDCHF Daily Technical Outlook and Review. Wednesday 18th June

This pair is becoming very frustrating to trade at the moment, with price action not showing much in the way of a clear direction.

A mini range seems to be forming between the highs above at 0.90116 and the lows below at 0.89643. Considering we are trading at quite an important area (Supply/Round number: 0.90381-0.90033/0.90000), this could very well be pro money accumulating a position, however the question we need to ask ourselves is, accumulating a position to trade in which direction?

We still have an active sell order in the market, as we may see lower prices from supply at 0.90381-0.90033. A break out of this mini range will certainly show us more information regarding possible direction; however we favor a break to the downside due to where price is currently located.

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen just above the daily S/R flip level (0.88501) at 0.88533. This level needs to see some confirming price action before any entry is placed in the market, due to their being no logical area for a stop loss order.

- Near-term P.A confirmation buy orders (Red line) are seen within demand (0.88973-0.89168) at 0.89029, just above the round number 0.89000, as price may retrace to demand to collect unfilled orders.

- The pending sell order (Green line) visible at the base of supply (0.90381-0.90033) just above the round number 0.90000 at 0.90063 still remains active, so keep a close eye on the first target area.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

USDCHF 4hr Chart (click to enlarge)

- Areas to watch for buy orders: P.O: There are no pending buy orders seen in the current market environment. P.A.C: 0.88533 (SL: Dependent on approaching price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed) 0.89029 (SL: likely to be set at 0.88784 TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: (Active) 0.90063 (SL: 0.90412 TP: [1] 0.89168 [2] 0.88501) P.A.C: There are currently no P.A confirmation orders seen in the current market environment.

- Most likely scenario: A mini range has formed (0.90116/0.89643) just below supply at 0.90381-0.90033, a break of this range will likely been seen south either today or tomorrow.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Source: IC Markets Trading Desk