Wave analysis of GBP / USD for January 23

Wave counting analysis:

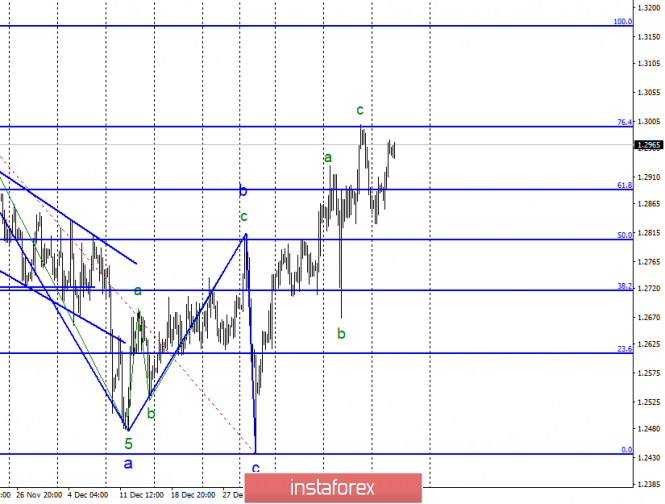

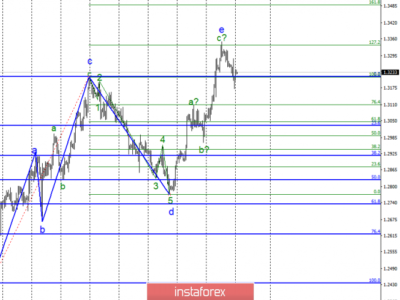

On January 22, the GBP / USD pair rose 65 bps. The estimated wave completed with its construction, as well as the entire three-wave segment of the trend. At the same time, the breakthrough of the Fibonacci level of 76.4% will lead to the complication of the uptrend of the trend, which takes its beginning on January 3, and further increase with targets located near the level of 100.0% of Fibonacci. The news background is still not on the side of the pound sterling, however, this does not prevent it from growing in recent weeks. Moreover, at any time, the currency of England may again be under pressure.

Shopping goals:

1.2997 – 76.4% Fibonacci

1.3168 – 100.0% Fibonacci

Sales targets:

1.2716 – 38.2% Fibonacci

1.2609 – 23.6% Fibonacci

General conclusions and trading recommendations:

A pair of GBP / USD shows willingness to build a downward set of waves. I recommend now cautious sales of the instrument, with targets located near the estimated marks of 1.2716 and 1.2609. At the same time, a successful attempt to break through the 1.2997 mark will lead to the complication of the uptrend of the trend.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Wave analysis of GBP / USD for January 23. A pound sterling keeps afloat.