10 Common Myths About Forex Trading

Specialised fields such as Forex trading are often rife with myths and misconceptions.

In today’s article we are going to look at 10 of the most common myths surrounding Forex trading in order to dispel them once and for all.

-

The Market is Fixed

Corruption and rigged pricing are often blamed for the failure of Forex traders.

The market itself is a relatively complex one, and certainly the largest in the world.

It can be affected by hundreds of thousands of inputs and transactions every day, so to point the finger at a corrupt broker or rigged market is to display a blatant misunderstanding of the complexities of the Forex market as a whole.

-

Forex is a Get-Rich-Quick Scheme

There appear to be a lot of people who believe that Forex trading is a great way of getting rich quickly with minimal effort involved.

Although there are some exceptions, people simply do not get rich quickly when trading Forex.

In fact, most traders can expect to run at a loss initially because it takes a lot of time and patience to develop the consistency required to become successful in the Forex market.

-

Trading More Pairs is Better

Less is often more when trading Forex, so although you may be led to believe that initiating more trades will lead to greater profits this is typically not the case.

A sound approach is usually to focus on just the few currency pairs that you understand well so that you can trade them effectively rather than spreading your knowledge and skills too thin.

-

Money may be Made by Predicting the Market

Many beginners attempt to predict the market, but the market itself is in a constant state of flux.

If you do attempt to predict the market then you should wait for the movement of your chosen currency in order to confirm your prediction before opening a trade. This is a far more rational approach.

-

Forex is for Short-Term Only

Short-term Forex trading has become incredibly popular due to the availability of leveraged funds; however, long-term currency trading is also highly feasible.

Fundamental factors and long-term trends create a world of possibilities for those of you who would prefer to trade long-term Forex.

-

Trading News is Easy

Trading news in real time is close to impossible for the majority of people.

The kind of analysis required to effectively open a position prior to a news-influenced press action typically involves having a solid strategy already in place.

-

You Can’t Get it Right Every Time

Simply put, you can’t expect all of your trades to be successful.

Even with the best strategy in the world you are still going to lose from time to time, sometimes significantly.

-

Money Management is All About Placing Stops

Minimizing your losses means practising sound money management.

Far from simply being just about placing a stop loss, money management involves taking a detailed assessment of the risk involved with each trade.

You should only be willing to risk a maximum of 1% of your total account balance on a single trade.

-

Complex Strategies may be the Best

When you first start trading you will probably opt for a relatively simplistic strategy.

After reaping some small returns from your strategy you may be tempted to change over to a more complex or “advanced” strategy.

The fact of the matter is, as long as you are winning more than you lose then you should stick to your current strategy because it clearly works.

Rather than attempting to change strategy try focusing on improving your money management instead as this may help to refine your approach rather than changing it altogether.

-

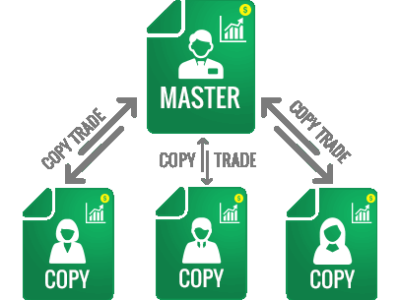

Monkey See, Monkey Do?

If only it were simple as copying what other successful traders are doing.

There are countless gurus and experts online and off-line, and although there is a lot of quality advice being dished out you need to develop your own personal experience for long-term success.

It is only with extensive trading experience that you will be able to filter the advice you receive in order to determine what is worth acting upon.