A Trend Trader’s Take on Risk Reward Ratio (RRR)

In my post How Much to Risk per Trade I went into the importance of having set measures in place to assist in preserving as much of your trading capital as possible. One such measure was to never risk more than a pre-determined % of your trading capital, as well as how traders should consider using the Risk Reward Ratio along with their own unique Historical Win Rate.

In this post I wish to take the concept of Risk Reward Ratio a little further, and in particular, highlight how to apply this measure when trend trading.

The general aim when using all these risk measures are as follows:

- Limit the effects of any one single trade to your overall portfolio

- Stack your trading edges in your favor so as to only take trades, or set targets that complies with pre-determined and qualifying criteria

- Prevent ones trading capital from slowly but surely dwindling away

As a trend trader, the use of a Risk Reward Ratio becomes a bit more subjective, and more often takes on a function of identifying or an estimation of the “Minimum Required Return”, …let me explain.

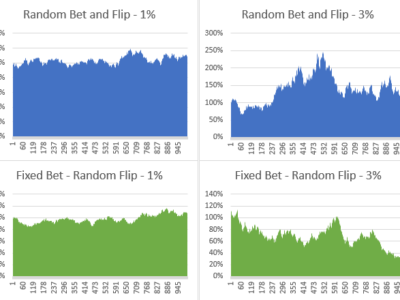

Given that part of trading is the expectation that many of the trades taken will not work out. A traditional RRR is of critical importance, along with your own Historical Win Rate, which when used together aims to determine which trades are good to take and which aren’t based on their ability to generate enough profit to counter the effect of the cumulative and expected losses taken.

Simply put, if for every $1 you risk, you expect a return of $1.50, this trade will have an RRR of 1.50, this in turn requires a win rate of 40% in order for your particular “trading style” to break even.

It logically follows then that if you can improve on the 40% win rate, or alternatively obtain a better RRR than 1.50, then only will your strategy be profitable (you can read in detail about this in my post How Much To Risk Per Trade).

RRR and Technical Analysis

There are many technical indicators and set-ups where one can predetermine, with relative accuracy, the expected profit targets of an anticipated trade (an example of this is via the use of triangle set-ups or Fibonacci retracement levels etc.)

This gets a bit trickier for Trend Traders though…..

The aim of trend trading is to catch as much of the trend as possible, in other words to ride it as long as the trade remains intact. A trend trader therefor, at inception of a trade, would not have such clear indications (as could be expected with exact technical set-ups) and therefore the ability to determine the trade’s RRR becomes a bit tricky. This is especially the case when considering that many trend traders will take a longer term view on the change seen in the trend (like a break out strategy or Moving Average etc) and would want to be in the trade for as long as it remains viable to do so.

It therefor is practically impossible for a trend trader to know the expected extent to which the trade can run. At best, the one thing a trend trader can control at inception is the stop loss level which will be applied to the trade. Don’t get me wrong, this ability to set the stop loss level is of crucial importance in general risk management and can be done in line with the “% Risk of Capital”. Thus at least you’ll have one of your bases covered.

A Major Challenge for Trend Traders

Once in a trade, one of the biggest temptation for a trend trader is to bank profits on a trade that is going well. In principal one can argue that this is not a bad thing, however the reality is that as a trader you really do need all the help you can get. So if I trade is making profits, you should try and maximise the profits while the going is good.

You really need those trades that every now and then banks a 10 x Risk, in order to give yourself a nice cushion. This is far easier than always trading right at the brink of your RRR stats.

While on this subject, let me also clear up one of the most common misconceptions you’ll hear from many traders (even those proclaiming to be professionals).

“One can never go broke taking a profit”

General Market Quote

This is not entirely correct, and here’s why….

As can be seen above, though you still had 4 Profitable trades (i.e. the win rate still remains 40%) – by taking profits too early, you never allow yourself the opportunity to recover all the profit that was set to counter the impact of the expected losses on the other trades.

So if you continue to “take profits” like this, you will consistently be grinding your portfolio balance lower until you are out of the game… assuming of course you don’t follow any of the other recommended risk mitigation techniques.

So how would Trend Traders use the RRR?

Seen below is an example of where one may enter a trade as a result of price action crossing downward through a major trend line.

At this point, you will have your stop loss levels set, and can manage the trade so that if the stop is triggered, you do not lose more than a certain % of Capital – so this rule remains firmly in tact…

However, as can be seen, there really is no way, at the onset of the trade, to predetermine to what levels the price will move in line with the trend.

Secondly, as the trade unfolds, one can be very tempted to take profit at consolidation levels thinking that the deal has run in your favor for a while and with an itchy trigger finger rather want to take profit off the table.

This is the point where a RRR calculator comes in handy.

Knowing your historical win rate one can make a judgement call on whether or not to take profits early.

In this instance, and especially since no threat to the trade exists, the RRR can be used to determine the most ideal, and minimum level at which one should consider taking profit. Reminder – you always need to be aware of the fact that your wins need to compensate for your losses.

If you keep taking profit early, and never banking the true RRR of your trading strategy, your calculations are incorrect and you will find your portfolio still dwindling away even though you appear to hit your win/loss ratios..

Now, once the Minimum Required Return level is reached, one still would not automatically take profit. Instead we would want this trade to run as long as possible..

So unless the trade dynamics have changed, the more prudent thing to do is to continue to adjust your stop lower (on a trailing stop basis) and wait to see how much more of the trade can unfold until you have to exit, riding the trend for as long as possible and banking multiple Risk Units as profit.

Think in “units of Risk”

It is very helpful to evaluate your trading strategies, and the exit points, against units of risk.

You would aim for the actual units of risk to be less than the actual units of profit you target, and in practice refrain from taking profits until the unit of profit on that particular trade matches your criteria (obviously outlier cases exists, but you get the picture).

In the end, you are playing with a “big game” mentality where over the long run your strategy will tilt the scale so that your units risk is overpowered by the units of profit (regardless if they occur less in frequency than the risky ones!)

The post A Trend Trader’s Take on Risk Return Ratio (RRR) appeared first on My Dad The Trader.