Analysis of EUR/USD and GBP/USD for August 8, 2019. The potential of the euro is still limited to 14 figures.

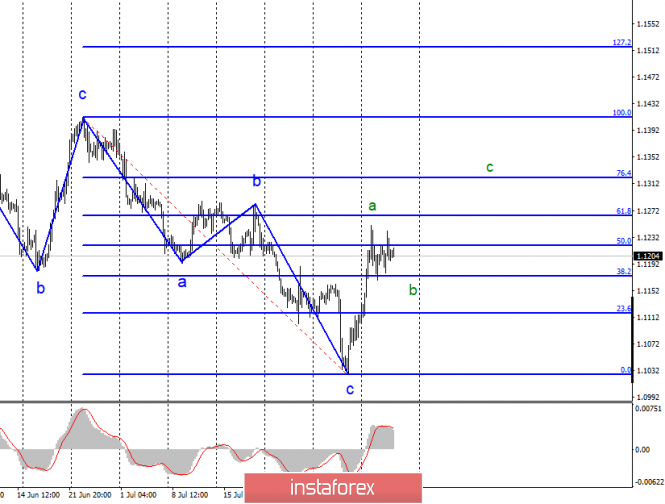

EUR / USD

Wednesday, August 7, ended for the pair EUR / USD unchanged. A second attempt was carried out to perform a breakthrough level of 50.0% Fibonacci, which failed. Thus, it is assumed that the euro-dollar pair is ready to build the correctional wave b, which could start its construction from the maximum of August 5. If this assumption is true, then, firstly, the instrument may decline to around 38.2% Fibonacci and even slightly lower, and secondly, before a successful attempt to break through the level of 50.0%, buying a pair again is not recommended, since the currency the market should confirm its readiness to build a new upward wave, presumably with. Moreover, the news background remains not in favor of the euro. The only economic report of the past day showed a decrease in industrial production in Germany by 5, 2% compared to June 2018 and 1.5% compared to May 2019. Such a strong decline may negatively affect the industrial production of the eurozone as a whole, and business activity in the manufacturing sector of Germany and the European Union has long been a signal of decline.

Purchase goals:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales goals:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair has moved to the construction of an upward trend section. Thus, buying a pair with targets near the levels of 1.1264 and 1.1322 is recommended, which is equal to 61.8% and 76.4% Fibonacci, for each MACD signal up, calculated on the construction of an upward wave with after completion b.

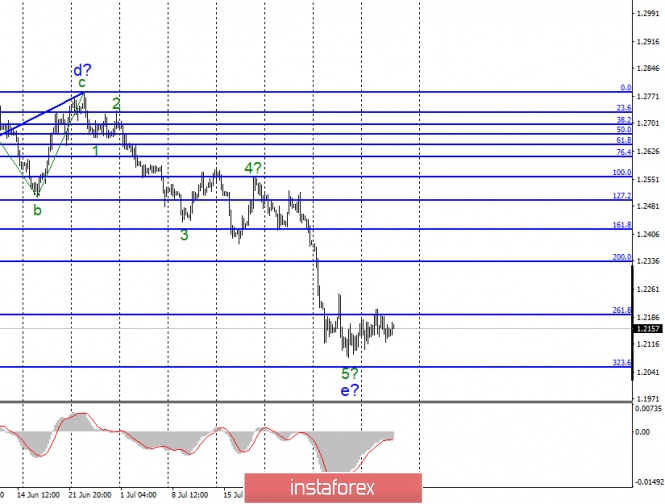

GBP / USD

On August 7, the pair GBP / USD fell by 30 basis points, which does not affect the current wave marking, which also suggests the construction of an upward trend section. However, the implementation of this scenario is constrained, firstly, by the 261.8% Fibonacci level, and secondly, the weakest news background for the pound. In fact, all the questions on the news background now come down to whether the next news from the UK will be completely disastrous or neutral. About the news that can help the foreign exchange market to conclude the advisability of buying the pound, not even a word. Boris Johnson seems determined to unleash a war against parliament, which is not going to support his “tough” Brexit initiative. Thus, Johnson is actively considering plans how to get around the parliament. In turn, the parliament is actively considering how to “fire” Johnson, which can lead the country into an impenetrable economic crisis with its desire to leave the European Union in any case and in any scenario. However, this phrase “according to any scenario” in reality means according to the scenario “without any agreements with the EU”.

Sales goals:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

Purchase goals:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound-dollar instrument involves the completion of the construction of the downward section. But until the successful attempt to break through the 261.8% Fibonacci level, the bears hope that the e-wave will become more complicated. Thus, selling the pair is recommended on the new MACD signal down with targets located near the calculated level of 1.2056. In addition, breaking through the level of 1.2192 will suggest the willingness to build a correctional set of waves.

The material has been provided by InstaForex Company – www.instaforex.com