Analysis of USD/JPY for July 9, 2019: USD regains momentum against JPY after NFP report

USD/JPY has been quite impulsive with the bullish momentum recently which lead the price to break above 108.50 area with a daily close. The Unite States released the upbeat employment report, so the American currency has managed to strengthen against the Japanese yen and is set to extend gains in the coming days.

Recently, the Bank of Japan has cut its assessment of the factory output for two of the country’s nine regions and warned that more companies were feeling pinched by the US-China trade war. Today, Japan’s Average Cash Earnings report was published with a slight increase to -0.2% from the previous value of -0.3% which was expected to decrease further towards to -0.6%. Besides, the M2 Money Stock report showed a decrease to 2.3% which was expected to be unchanged at 2.6%. The Japanese economy expanded an annualized 2.1% in the first quarter, but many analysts predict a slowdown in the coming months as the US-China trade conflict hurts exports. The sales tax hike scheduled in October may also curb consumption. What is more, Tokyo has recently stated that it would tighten restrictions on exports of three materials used in smartphone displays and chips, citing a dispute with Seoul over South Koreans forced to work for Japanese firms during World War Two. Moreover, Bank of Japan Governor Haruhiko Kuroda stated that the country’s economy was expected to expand moderately and gradually push the inflation toward the central bank’s 2% target.

On the other hand, the better-than-expected nonfarm payrolls report from the United States helped the American currency to regain certain momentum while the Japanese yen has been quite impulsive and non-volatile with the recent gains. The nonfarm payrolls increased by 224,000 jobs last month as the government employment rose by the most in 10 months, and construction and manufacturing hiring regained speed. The economy created only 72,000 jobs in May. The economy has shifted into lower gear as the stimulus from last year’s massive tax cuts and increased government spending fizzled. Additionally, the United States and China are set to relaunch trade talks this week after a two-month hiatus. However, a year after their trade war began it is unlikely that their differences have narrowed.

As of the current scenario, USD, having better fundamentals, looks more attractive to market participants that JPY. The pair is expected to lead to further gains on the USD side in the process. As the upcoming gains are still not quite definite, certain correction and increased volatility may be observed along the way.

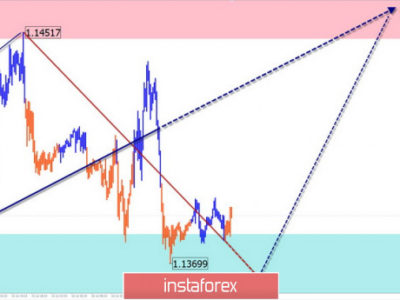

Now let us look at the technical view. The price is currently residing above 108.50 area, which is an important level from where it is expected to push higher towards 110.00-50 resistance area in the coming days. After the recent bounce off the 107.00 area, the bullish pressure has been quite consistent and may lead the price towards the strong psychological price area of 110.00-50 in the coming days.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Analysis of USD/JPY for July 9, 2019: USD regains momentum against JPY after NFP report