AUD and NZD are ready to resume growth; “oil panic” affects them less than the dollar

On Tuesday morning, markets are adjusting after a large-scale collapse at the opening of the week. May Brent futures added more than 7%, Nikkei 225 and Shanghai Composite added 1.06% and 1.76% as of 6.50 Universal time, respectively, the USD/JPY rate consolidated confidently above 104.

A deep correction shows that yesterday’s panic was largely excessive, but the trend still remains negative. The fundamental reasons that are pushing the global economy toward recession have not disappeared, and therefore, we can expect further movement after the correction towards cheaper oil, more expensive gold and a feverish search for the world Central Bank of “unconventional” measures that can stop the onset of the crisis.

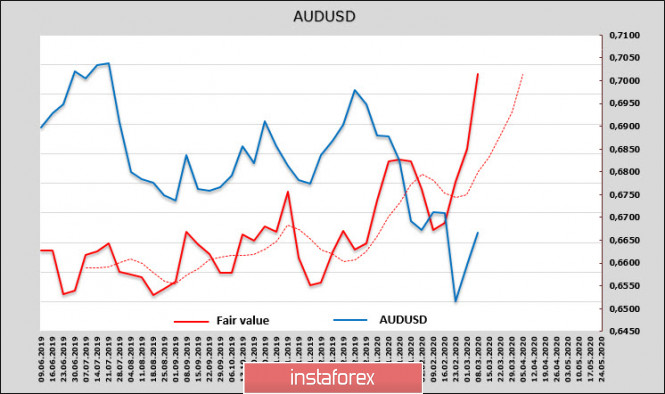

AUD/USD

After the oil crisis was superimposed on the negative effects of the coronavirus, it became clear that most Central banks will review their monetary policy in order to support national economies, and the RBA is unlikely to be an exception.

NAB Bank believes that the RBA will prepare a decision by April. In March, the RBA has already lowered the rate by 0.5% and another decrease to 0.25% looks very likely, but clearly insufficient. The rate cuts will hit the natural limit, which means that the time will come for unconventional steps, for example, control over the yield curve. Such control is a veiled form of quantitative easing when the RBA announces target levels of government bond yields and buys bonds if yields do not reach these goals. This approach has become obviously relevant in recent days, if we consider the dynamics of the AUD/USD rate and the estimated fair price. And it is very unusual against the background of growing panic:

The fair price of AUD is above 0.70, and this is despite the fact that the Aussie’s net short rose at the end of the week, according to the CFTC report, and the stock market fell at about the same rate as in other countries. Moreover, the gap was created primarily because the fall in the yields of Australian government bonds was significantly weaker than the similar US Treasures. For example, the yields of 10-year-old Treasuries declined by half relative to the end of last week, and Australian – by only 10-20%. Hence, the fears that the Fed will take much more aggressive steps to regain control of the situation, which will lead to a stronger weakening of the dollar than the Australian currency, since the higher yield of Australian securities will not force the RBA to aggressively buy them even with the introduction of measures to control the curve profitability.

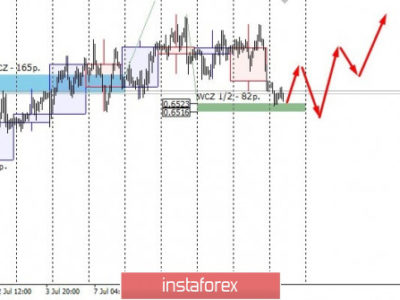

On Tuesday morning, AUD/USD is correcting down, but you need to be prepared to resume growth. The supports are at 0.6539 and 0.6494, while growth to 0.6684 can begin at any time.

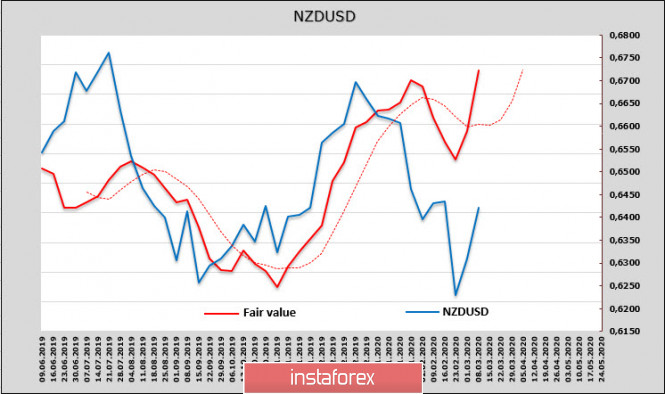

NZD/USD

The previous mentioned regarding the prospects of the Australian dollar fully applies to its New Zealand counterpart, since their reaction to recent events is very similar.

Firstly, the dynamics of the spot and estimated fair prices are similar, the grounds are the same – despite the minimal growth of the net short-term position of NZD, there is no excessive buying of bonds, nor is the fall in the stock market as pronounced as in American or European markets.

Secondly, approximately the same reaction is expected from the RBNZ as from the RBA. As ANZ Bank suggests, the RBNZ will reduce the rate by 0.5% at the next meeting, and by May, it may bring it to the level of 0.25%, which will stop. At the same time, ANZ uses the same arguments, and just as well notes the risks of launching an unconventional monetary policy as the NAB bank for the RBA.

The morning downward correction for NZD/USD is unlikely to be prolonged. The probability of resumption of growth remains high; therefore, the pullback can be considered as an opportunity to buy from lower levels. The supports are 0.6282 and 0.6218 and the goal is to update the recent high and consolidate above the level of 0.6460.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: AUD and NZD are ready to resume growth; “oil panic” affects them less than the dollar