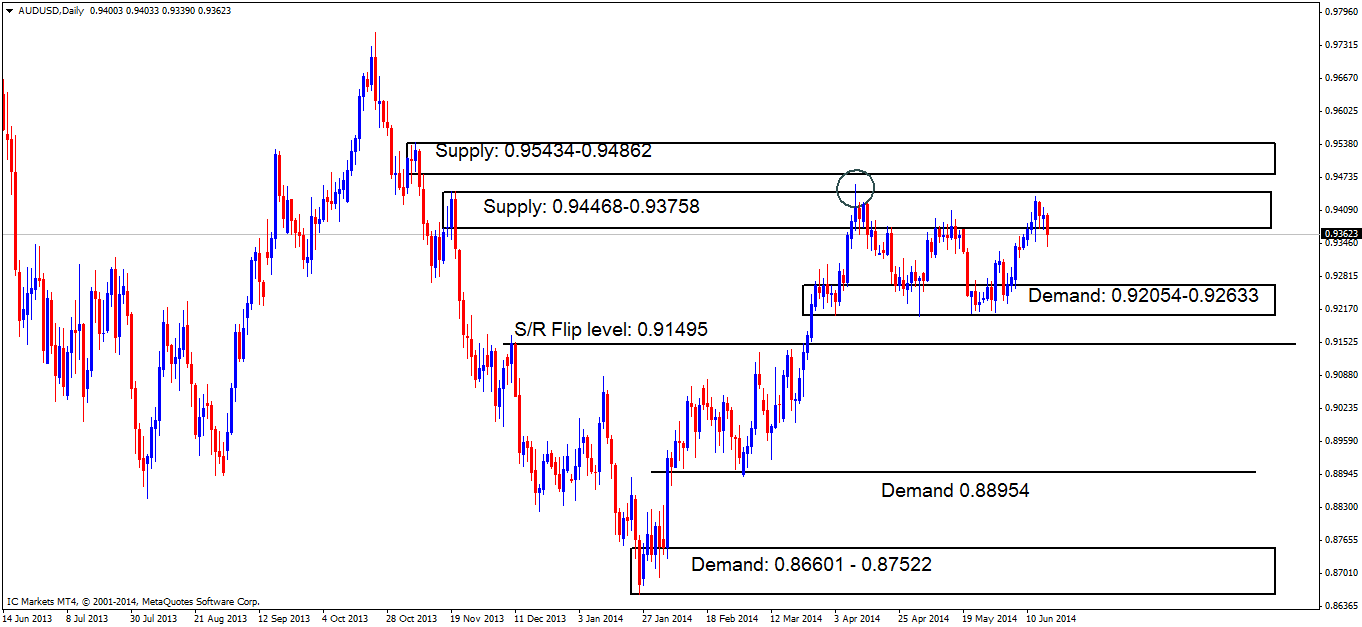

AUDUSD Daily Technical Outlook and Review. Wednesday 18th June

A quick reminder of the daily timeframe shows sellers exhibiting a little more interest than before within supply at 0.94468-0.93758. Be that as it may, we must not forget that this supply area is possibly weak, as the wick/spike (circled) likely consumed most of the sellers in and around this area, so as always, remain aware, and expect the unexpected!

AUDUSD Daily Chart (click to enlarge)

4hr TF.

Price has certainly been more active than seen on Monday! A sharp drop took place yesterday on the AUD, as explained may happen in yesterday’s analysis.

A drop may have been seen, but the sellers have yet to push price down to its full potential, as there is more room to the downside with little stopping price from hitting the round number below at 0.93000. The zone between the D/S flip area at 0.93186-0.93345 and the round number 0.93000 marked with a check sign, appears to be a lovely area for a fakeout in the near future.

A push to the upside may still come to light. A new mini downtrend line has been attached to the chart, again, like yesterday, this is not to show a trend, it is more to show how pro money has likely been consuming small supply pockets on the lower timeframes whilst price is still dropping, thus if price manages to rally, and consume the circled area (0.94000,) there will be little to stop the buyers pushing price up to the highs (marked with a circle to the left) at 0.94613 where we currently have a pending sell order set at 0.94447.

- No pending buy orders (Green line) are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen at 0.92231 just above demand at 0.92037-0.92203. It would be too risky to set a pending order around this area, since deep spikes into this demand zone have been seen (levels above) possibly consuming the majority of buyers in the process.

- P.A confirmation buy orders (Red line) are visible just above the round number 0.93000 at 0.93025. We require confirmation of this level because previous price action has warned us deep tests both north and south happen on a regular basis, hence the need to wait for confirmation rather than getting stopped out time after time through lack of patience.

- Pending sell orders (Green line) are seen at 0.94447, if price manages to get up to this level, active sellers are likely waiting because of how quickly price changed in direction, only pro money have the account size to do this, indicating unfilled sell orders may still be unfilled there.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

AUDUSD 4Hr Chart (click to enlarge)

- Areas to watch for buy orders: P.O: No pending orders are seen with current price action. P.A.C: 0.92231 (SL: more than likely will be at 0.91984 TP: Dependent on approaching price action after the level has been confirmed) 0.93025 (SL: Dependent on approaching price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 0.94447 (SL: 0.94667 TP: Dependent on approaching price action after the level has been confirmed). P.A.C: No P.A confirmation sell orders seen in the current market environment.

- Most likely scenario: Due to recent unfolding price action seen yesterday, price may see higher prices sometime today to around the highs (0.94613), especially with a possible extra push from the FOMC statement being announced later today.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Source: IC Markets Trading Desk