$AUDUSD Daily Technical Outlook and Review – Friday 29th August

The higher-timeframe picture resembles the following:

- Weekly TF: Price is still frustratingly trading within a weekly consolidation area with the upper limits seen at 0.94600, and the lower at 0.92046, with no signs of a break happening just yet.

- Daily TF: Price still remains caught trading between the daily demand area 0.92046-0.92354, and a daily decision-point level at 0.93529. A spike/wick above the aforementioned daily decision-point level at 0.93529 was recently seen; could this spike have potentially cleared the sellers here, and cleared the path up to the daily supply area at 0.94729-0.94175?

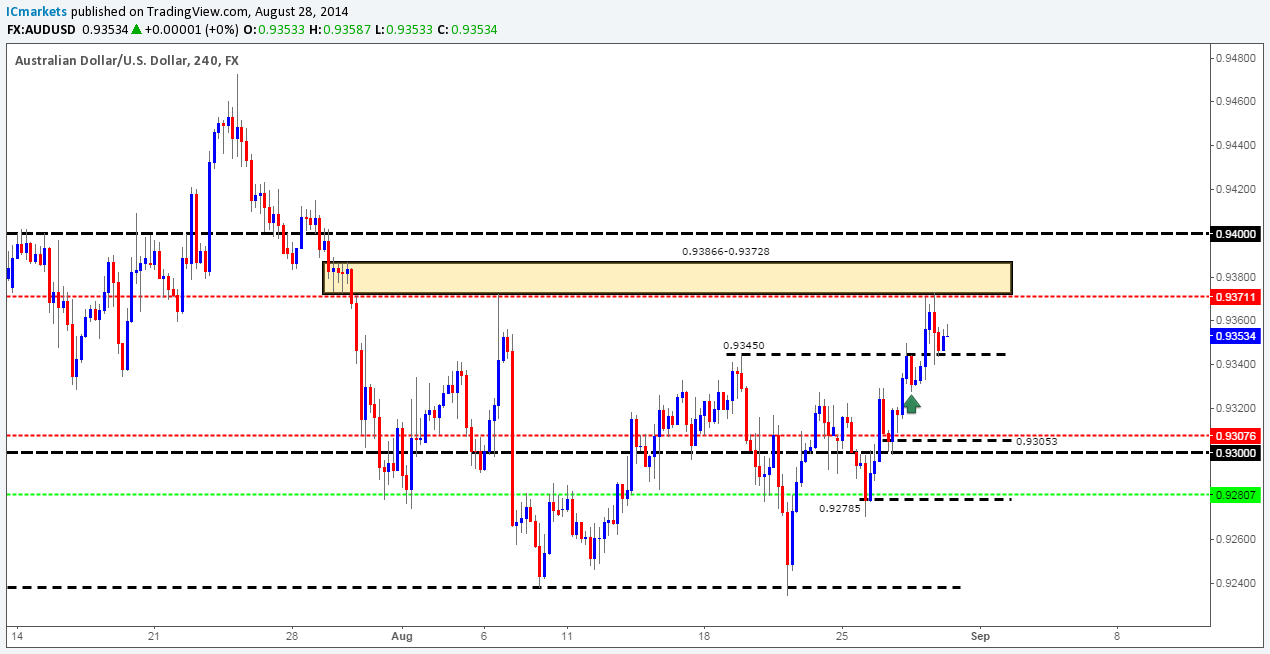

A beautiful to-the-pip reaction has been seen around the base of 4hr supply at 0.93866-0.93728 (P.A confirmation sell level was triggered [0.93711] in the process). It appears for the time being buying interest is being seen around a minor 4hr R/S flip level at 0.93450, be that as it may, for us to even consider setting a pending sell order around the aforementioned 4hr supply area, a push below low marked with a green arrow at 0.93279 would have to happen.

Here is a quick reminder of what areas of 4hr ‘demand’ we’ll be watching if price continues south past the aforementioned 4hr low:

Our original pending buy order still remains the same (0.92807) just above a fantastic-looking 4hr decision-point level at 0.92785. We have also added a P.A confirmation buy level just above (in our opinion) a minor 4hr decision-point level (0.93053) at 0.93076. This area is likely where the decision was made to break above the high 0.93450, so it remains important, however not as much as the level below it (0.92785)! The reason being is we see the lowest 4hr decision-point level to be the overall origin of the rally higher, indicating that pro money may well just use the 4hr decision-point level at 0.93053 as a ‘dummy-fake’ level, in which to push price below to the aforementioned origin, hence we have set a P.A confirmation level there rather than a pending buy order.

Pending/P.A confirmation levels:

- Pending buy orders (Green line) are seen just above a 4hr decision-point level (0.92785) at 0.92807. We have placed a pending buy order here because this level remains untouched, and Is effectively where pro money buyers likely made the decision to push prices above the round number 0.93.

- P.A confirmation buy levels (Red line) are seen just above a 4hr decision-point level (0.93053) at 0.93076. The reason for not setting a pending buy order here is simply because we believe pro money may push below this level to the overall origin of the move up (4hr decision-point level at 0.92785).

- No pending sell orders (Green line) are seen in the current environment.

- The P.A confirmation sell level (Red line) set just below a 4hr supply (0.93866-0.93728) at 0.93711 is now active. The sellers will need to confirm this area by consuming some or most of the buyers around the low marked with a green arrow at 0.93279, we will then consider setting a pending sell order awaiting a possible return.

Quick Recap:

Remains the same as the last analysis:

Our P.A confirmation sell order has been triggered just below 4hr supply (0.93866-0.93728) at 0.93711, The sellers will need to confirm this area by consuming some or most of the buyers around the low marked with a green arrow at 0.93279, we will then consider setting a pending sell order awaiting a possible return. However if no return is seen, and price keeps declining, we will be watching two levels (0.93053 [A P.A confirmation buy level is set above at 0.93076]…0.92875 [A pending buy order is set just above at 0.92807]).

- Areas to watch for buy orders: P.O: 0.92807 SL: 0.92661 TP: Dependent on how price approaches) P.A.C: 0.93076 (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: No pending sell orders seen in the current market environment. P.A.C: 0.93711 (Active-awaiting confirmation) (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).