Brent allowed the enemy to get closer

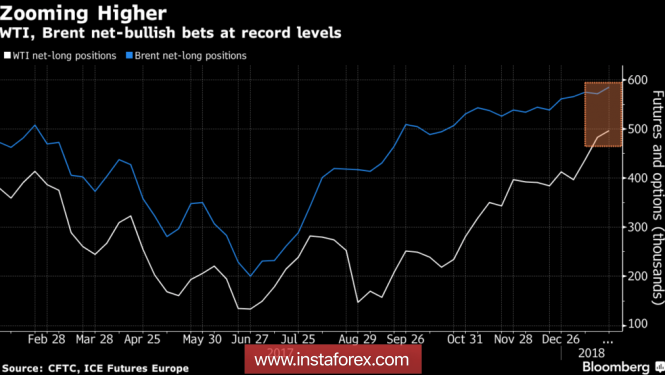

Futures for North Sea variety for the first time in the last six days has fallen below $69 per barrel. A number of bullish news, including Saudi Arabia’s lack of concern over the growth of US shale mining and Riyadh’s announcement of a long-term (“for decades and whole generations”) cooperation with Russia, could not stop the process of profit-taking on record-breaking net longs. The indicator reached 584,707 contracts, increasing by the end of the week by January 23, to 2.4%. Correction on world stock exchanges and stabilization of the US dollar forced individual “bulls” to come out of long positions.

Dynamics of speculative positions on oil

Source: Bloomberg.

Information about the possible decline in US stocks was on the hands of the “bears”. This can happen for the first time in the last 11 weeks.

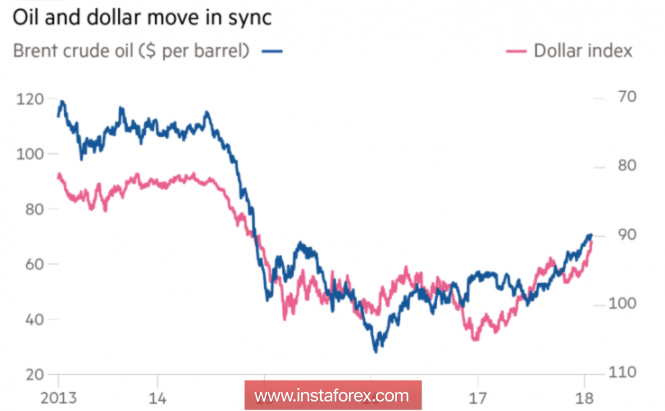

Several fans of oil were scared of the US dollar rising from the ashes. Donald Trump’s desire to see a strong currency as a reflection of the strength of the US economy made the “bears” in the USD index think three times before resuming selling. The “Greenback” has a lot of trump cards, including the monetary tightening of the Fed and the dispersal of GDP under the influence of tax reform, so its growing relationship with Brent and WTI can seriously complicate the life of the latter.

Dynamics of Brent and USD index

Source: Financial Times.

At the same time, correlation is not a cause-and-effect relationship, and the multidirectional dynamics of the dollar and oil in 2017 was not a result of each other’s behavior. The first one fell due to the readiness of other central banks to normalize monetary policy, the second was strengthened due to the growth of global demand against the background of balanced supplies. This is evidenced by the conjuncture of the futures market of oil, where for the first time since 2014 there was a backwardation. It, in general, emerges against a background of strong demand and declining supply. Thus, we can assume that the peak of the USD index to the 3-year-old low and Brent’s growth to the peak mark in the last three years is rather an accident than a regularity.

However, to argue that oil and the US dollar do not influence each other would be a mistake. Oil is quoted in US currency, and an increase in its value leads to higher prices for imports from the US. In the latter case, the situation is not as critical as, say, in 2008, when Brent was quoted at $145 per barrel. In 2017, oil supplies from the US dropped to 2.5 million b/s, the lowest since 1970.

Thus, it is doubtful that the rollback on both grades has turned into a deep correction, not to mention the change of trend. Most likely, the drop in quotations of Brent will be used by large players to form new long positions. In addition, before continuing the rally, it would be nice to get rid of the ballast and trim record net long positions.

Technically, while quotes are located above support at $ 66.95 per barrel, total control over the oil is kept by the bulls.

Brent, daily chart

The material has been provided by InstaForex Company – www.instaforex.com