Bullet Report: USD Retreats Further | Oil plummets On Supply Data

It will be another quiet day in terms of data releases today. Overnight, the Reserve Bank of New Zealand cut rates to 2% which was fully expected. Since this was priced in, the Kiwi rebounded to its highest level in more than a year. Currency markets focus remains on whether the Federal Reserve will raise U.S. interest rates this year, with investors looking ahead for clues from Fed Chair Janet Yellen’s speech on Aug. 26 at the U.S. central bank’s annual symposium in Jackson Hole, Wyoming. Until then, Friday’s Retail Sales remain the next most important US related news event

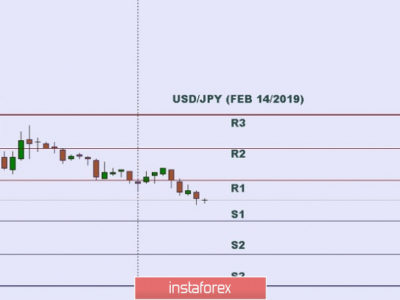

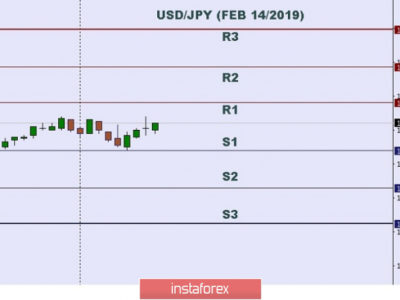

Currencies: USD remains the weakest currency this week. EUR remained steady at 1.1172, having gained 0.7% this week. USDJPY was thin as Japan markets are on holiday. The pair is trading lower from its peak to 102.66 on Monday as stock markets are now in a corrective mode. The pair EUR/GBP has also reached new post Brexit highs and has now risen six consecutive days

Stocks: Shares in Asia were broadly down early Thursday, as a rise in crude oil inventory and expanding production in Saudi Arabia sent oil prices lower. Australia’s S&P/ASX 200 was trading down 1.0%, while Japan was shut for a holiday Thursday. Overnight, U.S. crude oil prices fell 2.5% to $41.71 a barrel, after the Energy Information Administration said inventories of crude rose, contrary to expectations of a decline.

Oil and Gold: Gold prices edged lower in European trade on Thursday as investors evaluated the likelihood that the Federal Reserve will raise interest rates this year, with no major new economic indicators due until Friday’s highly anticipated retail sales report. Gold shed $8, or 0.6%, to trade at $1,341 a troy ounce. Gold is sensitive to moves in U.S. rates. A gradual path to higher rates is seen as less of a threat to gold prices than a swift series of increases. WTI oil fell 2.5% Wednesday to $41.71 a barrel, after the Energy Information Administration said inventories of crude rose in the week ended Aug. 5, with the market expecting a drop. Brent crude was trading 0.4% lower in morning Asian trade Thursday

The post Bullet Report: USD Retreats Further | Oil plummets On Supply Data appeared first on Forex.Info.

Source:: Bullet Report: USD Retreats Further | Oil plummets On Supply Data