Buy USDCAD – Forex Trading Tips

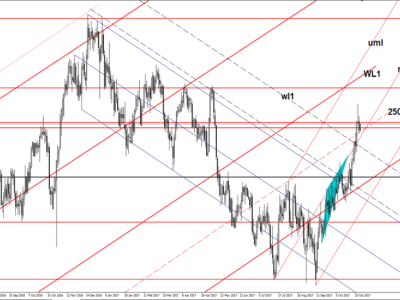

Our trade call is to buy USDCAD at 1.2950, or for the more aggressive trader, buy at market. This trade is heading into the GDP figure.

If we get a pullback to the 2950 area and WTI does not rally then it will be a safer entry than entering at market, however it may not pull back. As the Canadian economy is slowing and oil has seen a steady decline in recent months, our bias is to the downside in CAD. Growth is expected flat for the month of May. This is a high risk trade leading into the data release and the risk of a positive deviation needs to be accepted for this trade.

Current Market Sentiment:

The DXY strengthened during the NY session after US Advance GDP showed the US economy accelerated modestly in the second quarter following a sluggish start to 2015. The figure printed 2.3%, slightly less than the forecast of 2.6%, however the Commerce Department said the economy grew at a rate of 0.6% in the first quarter, and sharp upward revision from the previously reported 0.2% contraction. Another positive USD catalyst was weekly jobless claims which remained at rock bottom levels, at a lower-than-expected 267,000 in the July 25 week vs an unrevised 42-year low of 255,000 in the prior week. Bullish sentiment on the greenback is expected to remain.

The Asian session today has seen a string of various data; Tokyo Core CPI from Japan showed deflation for the year ending July 31, printing -0.1% versus expected flat. The Nationwide Core CPI showed slightly better than expected at 0.1%, however this was for the year ending June 30. Low inflation is negative for the yen and may prompt the BOJ to increase stimulus in the future.

Australian & New Zealand Bank (ANZ) released their business confidence survey for NZ which showed a very poor print of -15.3. This is the lowest level of business confidence since March 2009 – yet another indication that the Kiwi economy is not in great shape. This simply confirms our bearish bias on the currency and Kiwi moved lower on release.

The Asian session also saw PPI from Australia come in at 0.3% versus prior of 0.5%. There was little reaction in Aussie. The Shanghai Composite is lower on the day.

Looking ahead today we have Eurzone CPI and then Canadian GDP. (Find out more about those events here)

To get daily market insights from Jarratt Davis delivered to your inbox simply enter your name and email below:

The post Buy USDCAD – Forex Trading Tips appeared first on Jarratt Davis.

Source:: Buy USDCAD – Forex Trading Tips