Canadian Dollar Weakens as BOC is Poised to Continue to Ease

The Bank of Canada’s rate cut left a low threshold for further accommodative action, as their patience for the rotation to an export driven economy and subsequent rebound in growth has been exhausted. There is a strong argument against additional accommodation, yet any risk associated with ultra-accommodative policy will be overshadowed by concern at the Bank over the lingering impact of the oil shock on the domestic economy. The poor showing for May manufacturing and wholesale shipments have stoked expectations for another rate cut this year, while continued downward pressure on crude oil prices also add to easing pressure.

A key question going into last week’s announcement was weather current conditions were sufficient to move rates to 0.50%, a level that was last seen during the 2008/09 recession. While the economy is struggling under the weight of the oil price shock, there is no broad-based and sustained contraction evident in the wake of the global financial crisis. The difference seemed too argued against a July rate cut. Exports and investment tipped the balance however. Governor Poloz helpfully explained that the Bank of Canada’s concerns were focused on oil sector investment, which was on track to contact by an even greater amount than had been anticipated at the time of the April MPR.

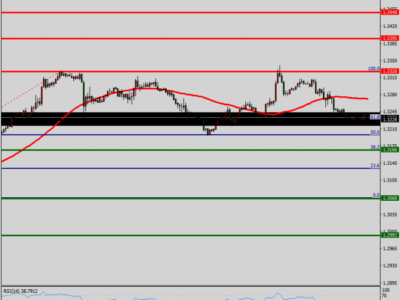

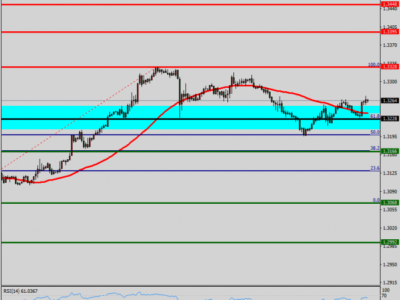

Accommodative policy will remain in play globally through year-end and well into 2016. The Fed will likely hike rates later this year, but the projected increases will take it away from ZIRP to merely ultra-accommodative rates on a historical basis. A lack of encouraging developments on exports and sustained weakness in oil prices would necessitate another rate cut in September, based on the Bank of Canada’s current policy parameters. Interestingly, that would occur in the same month that the Federal Reserve is likely to raise rates. A better U.S. growth backdrop should eventually help give the Bank its long desired investment and export improvements, which could prompt a faster take-back of stimulus well down the road than would have been the case when policy was at 1.00%. This backdrop will continue to allow the USD/CAD to move higher.

The post Canadian Dollar Weakens as BOC is Poised to Continue to Ease appeared first on Forex Circles.

Source:: Canadian Dollar Weakens as BOC is Poised to Continue to Ease