Candlestick analysis of NZD / USD on July 12

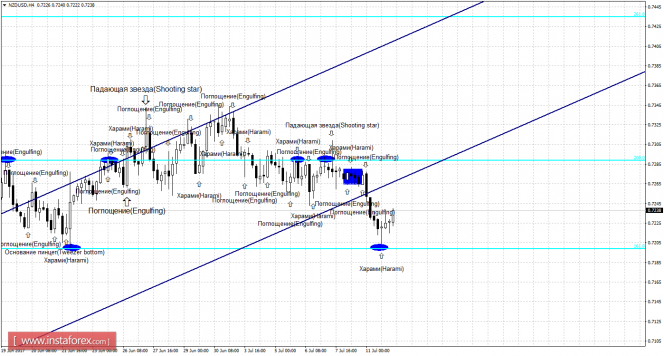

4h

Prices hang up from the correction level of 161.8% to 0.7199 and the formation of bullish Harami candlestick pattern are working in favor of the New Zealand currency.

The expansion started in the direction of the corrective level of 200.0% – 0.7289.

The NZD / USD consolidated below the correction level of 161.8% which will increase chances of further decline in prices towards the next corrective level of 100.0% – 0.7053.

The Fibonacci grid is placed on extremes from April 24, 2017 and May 11, 2017.

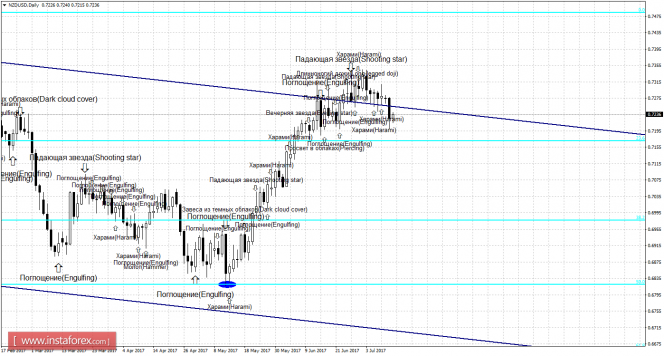

Daily

The weakening of the NZD / USD pair continues as shown the 24-hour chart towards the direction of the correction level of 23.6% – 0.7172. The pair’s retracement level of 23.6% is expected to allow traders make a move favorable to the New Zealand currency and some development approaching the correction level of 0.0% – 0.7484. The formation of the bullish candle pattern will also work inclined with the initial growth of the pair. The pair consolidated below the Fibo level of 23.6% had increased chances of continuing the decline towards the next correction level of 38.2% – 0.6977.

The Fibonacci grid is located on extremes from August 24, 2015 and September 8, 2016.

Specification:

Weak candle formations will be marked with plain text and a smaller size of arrows.

Strong candle formations will be marked with bold text and a larger size of arrows.

The material has been provided by InstaForex Company – www.instaforex.com