CHF Update 6th of November

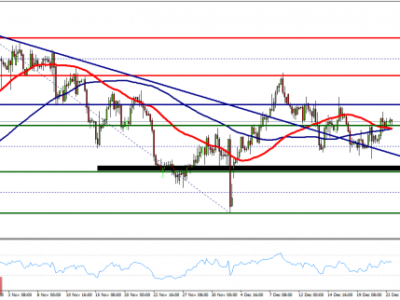

The CHF appears to have begun behaving like a normal currency after a long period of not responding to fundamental economic data due to various confounding factors. These factors which saw the franc somewhat immune to the fundamentals include the implementation and subsequent disastrous removal of the franc cap, the constant threat and occasional act of intervention by the SNB and the franc’s status as a safe-haven asset which causes it to strengthen on market uncertainty. Now these factors are fading into the background, we are seeing the franc act more rationally and in line with fundamentals – as evidenced by its weakening after the recent poor CPI reading. The franc remains a bearish currency, but now Swiss data should be monitored more closely for trading opportunities.

CHF Update:

Interest Rate

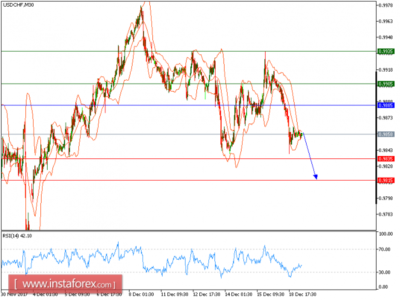

3M Target LIBOR Rate: -0.75%

Last Change: January 15, 2015 (-0.25%)

Expected Future Change: There are currently no expectations for changes to interest rates

Next Decision: December 10

Inflation

Inflation Target: <2%

Period: Year ending September 30

CPI: -1.40%

Next Release: November 5

Employment

Period: September

Unemployment Rate: 3.4%

Next Release: November 10

Growth

Period: Year ending June 30

GDP: 1.2% Expected: 0.9%

Next release: November 26

Analysis

The franc has seen recent weakness partly due to inflation concerns and the September print didn’t help matters any. While consumer prices were much as expected the overall picture remains worryingly soft and potentially weak enough to trigger an additional monetary ease at some point. The weakening of the franc on the back of the worsening inflation situation signals that the franc may be starting to behave like a normal currency and respond to fundamental data. This has not been seen for years, since the franc cap was put in place which inhibited the franc from moving freely against the euro.

The Bloomberg monthly survey published on October 20 showed the SNB may intervene in the FX markets in order to stem the appreciation in the CHF in case the ECB expands its stimulus. 63% of economists surveyed by Bloomberg predict the SNB will respond to ECB with their own interventions, and after very dovish comments from the ECB’s Draghi on October 22, this scenario is becoming increasingly more likely.

At the rate decision on September 17, the SNB kept monetary policy unchanged with mid-point of the 3-month Libor range at -0.75%. There was some slight speculation that the Bank could widen the scope of negative rates on sight deposits however a change such as this may be more likely to occur at the December meeting which is followed by a press conference. The September Monetary Policy Assessment contained no major surprises but did revise inflation forecasts lower. Jordan reiterated that the franc is overvalued and that negative rates will remain for the foreseeable future.

Swiss Gross Domestic Product for Q2 beat estimates of a 0.1% contraction to show 0.2% growth for the 3-month period. This translated to 1.2% growth over the prior 12 months. These figures beat analysts’ estimates however inflation remains subdued in the country and this will remain the key metric to get back on track before any optimism surrounding Switzerland’s economy can materialise.

The post CHF Update 6th of November appeared first on Jarratt Davis.

Source:: CHF Update 6th of November