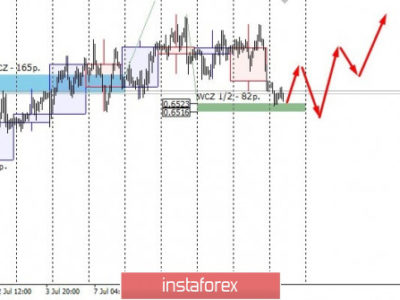

Control zones for NZD/USD on Apr 30, 2020

Today, the pair tested the target zone of the weekly control zone 1/2 0.6154-0.6147. In addition, the pair reached a monthly short-term limit. This may be a reason to stop growth and form a corrective downward model. It is important to understand that the upward movement remains a strong medium-term impulse, therefore, you should only enter a short position after the formation of a reversal pattern.

The probability of growth in the medium term is above 70%, which will make it possible to re-enter purchases after the formation of the correction model.

An alternative model will be developed if the closure of today’s trading occurs above the weekly control zone 1/2. This will open the way for further growth and indicate support for major buyers. It is important to understand that purchases from current levels are not yet profitable, since the pair is trading at a monthly maximum and testing significant zones.

Daily CZ – daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ – weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ – monthly control zone. The zone that reflects the average volatility over the past year.

The material has been provided by InstaForex Company – www.instaforex.com