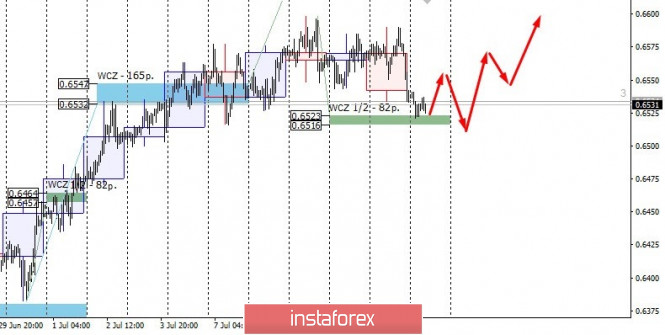

Control zones for NZD/USD on July 14, 2020

Today’s test of the Weekly Control Zone 1/2 0.6523-0.6516 gave an opportunity to enter the purchase, however, it is important to note that the probability of a sharp increase and renewal of the weekly maximum is reduced due to the formation of the “absorption” pattern of the daily level. Now, the pair is trading within the local accumulation zone, so the purchase of the instrument is of a medium-term nature.

A short-term price hold within the flat is most likely in the current situation. A repeated breakdown of the local minimum of the week is also likely, which will allow you to get a “false breakdown” pattern.

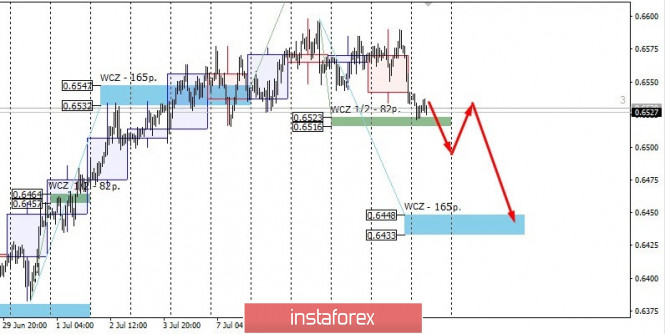

An alternative pattern will be developed if today’s closing of American session occurs below the Weekly Control Zone 1/2. This will open the way for the pair to begin to decline. The target of the bearish impulse will be the weekly control zone 0.6448-0.6433. Today, sales are not yet profitable, so the continuation of the decline is considered only for the subject of reaction to the Weekly Control Zone 1/2.

Daily CZ – daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ – weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ – monthly control zone. The zone that reflects the average volatility over the past year.

The material has been provided by InstaForex Company – www.instaforex.com