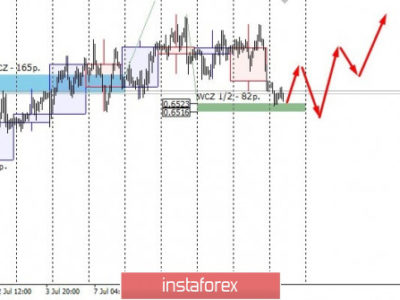

Control zones for NZD/USD pair on 05/24/19

Today’s movement relative to 1/4 WCZ of 0.6519-0.6515 will allow determining further priority. If the closure of Asian trading occurs above the zone, then the continued growth will be the basis for trading at the end of this week. The determining resistance is the 1/2 WCZ of 0.6555-0.6548. While the pair is trading below this zone, the bearish momentum remains a priority. The most favorable prices for sale are located within the above 1/2 WCZ.

Yesterday’s growth led to the formation of the previous day’s takeover model. This indicates a high probability of updating yesterday’s high.

An alternative model will be developed in case the pair fails to consolidate above the 1/4 WCZ. The resumption of the fall will be a priority and the goal will remain the 1/2 WCZ of 0.6459-0.6451. All of these this will make sales from current rates to be profitable -both in terms of probability and in relation to risk and profit.

Daily CZ – daily control zone. The area formed by important data from the futures market, which changes several times a year.

Weekly CZ – weekly control zone. The area formed by marks from the important futures market, which changes several times a year.

Monthly CZ – monthly control zone. The area is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company – www.instaforex.com