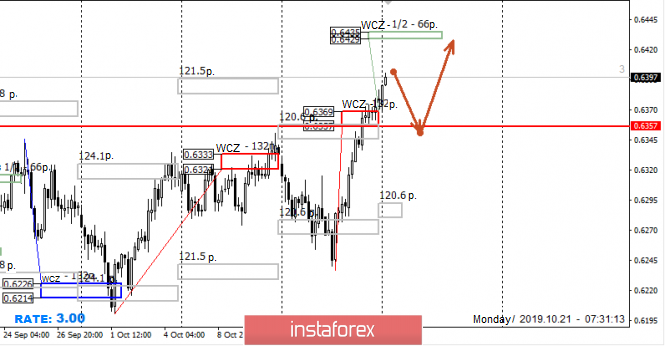

Control zones NZD/USD Oct 21, 19

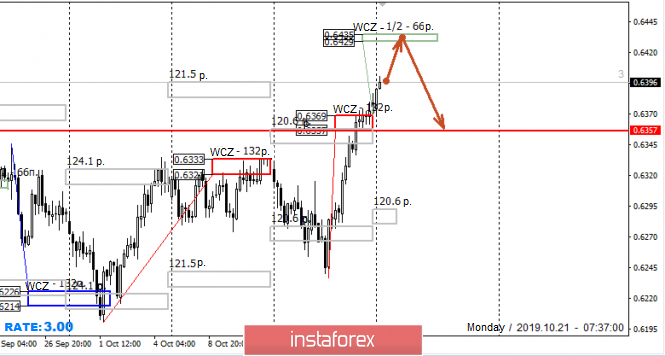

The closing of last week’s trading occurred above the average move. This makes it possible to get a better price. The probability of a return to the upper boundary of the average course of the last week 0.6357 is 90%, which makes it possible to buy an instrument after correction.

Purchases from the current levels are not profitable. Therefore, the formation of a correctional model is required. After the formation of a local maximum of the current week, it is necessary to build a control zone and place a limit buy order.

An alternative growth model is being formed. The growth target is the Weekly Control Zone 1/2 0.6435-0.6429. Testing this zone will allow you to consolidate the next part of a long position and consider sales after the formation of the pattern of “false breakdown”. This will allow working to return to the average weekly move at the level of 0.6357.

Daily CZ – daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ – weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ – monthly control zone. The zone that reflects the average volatility over the past year.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Control zones NZDUSD 10/21/19