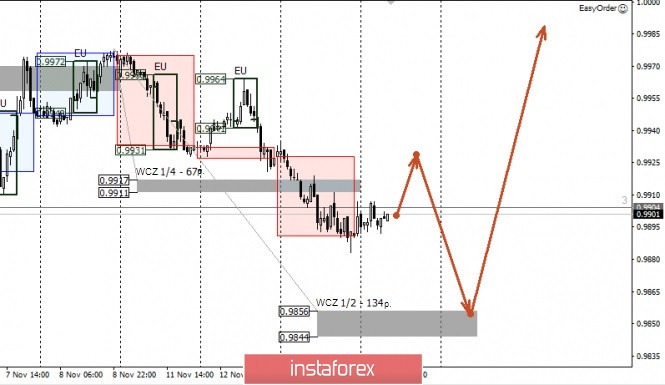

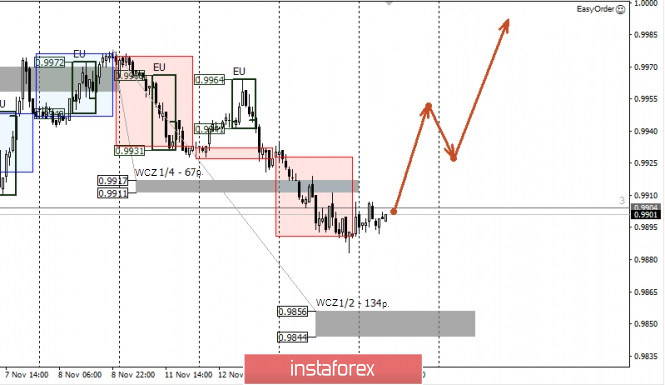

Control zones USD/CHF Nov 14, 2019

Yesterday, trading closed below WCZ 1/4 0.9917-0.9911. This indicates an increase in the probability of continuation of the downward movement to the WCZ 1/2 0.9856-0.9844. This model fits into the framework of the medium-term flat, so sales from the high of the previous day will be profitable in the case of the formation of the “absorption” pattern.

The position of the European sessions indicates support for the Swiss franc rate by the national bank.

To break the downward structure, it will be necessary to close today’s trading above yesterday’s high. This model will give an impetus to update the monthly maximum and implement the upward medium-term model. It should be understood that purchases from current levels are not profitable due to the breakdown of WCZ 1/4 yesterday.

Daily CZ – daily control zone. A zone formed by important data from the futures market that changes several times a year.

Weekly CZ – weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ – monthly control zone. A zone that reflects the average volatility over the past year.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Control zones USDCHF 11/14/19