Correction for euro

Previous:

The euro/dollar on Wednesday reached 1.1190 thanks to purchases of the euro for the British pound after a failed BoE auction. The central bank didn”t manage to acquire enough long-term state bonds as part of its program.

Market expectations:

Today I wanted to consider a rise for the euro to 1.1220, but the weak nature of the pound and commodity currencies forced me to go for a fall to 1.1137. The upward movement from 1.1046 to 1.1190 wasn”t complete. Keep an eye on whether the buyers will be able to pass the 1.1155 support or not. The euro/pound cross is on the side of the buyers, so to sell euro against the dollar is a bit risky. The economic calendar in Europe is empty.

Day”s News (EET):

- 15:30, Canadian primary market housing sales index for June;

- 15:30, US initial unemployment benefit applications for the week ending 7th August and import price index for July.

Technical Analysis:

Intraday forecast: minimum: 1.1137, maximum: 1.1191 (current Asian), close: 1.1159.

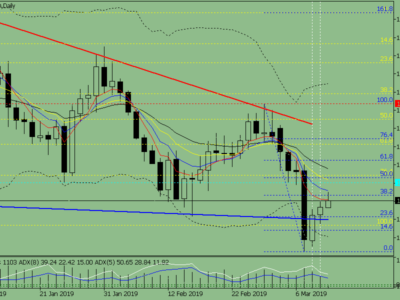

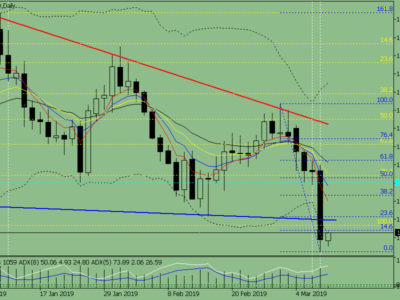

Euro/dollar rate on the hourly. Source: TradingView

On Wednesday the euro/dollar restored to 1.1190. The zone between the 112 and 135 degrees is an inverted one, so the risks of a correction to the 45th degree are up for the pair. If the 1.1150-1.1160 support zone holds back any rush from the sellers, I don”t exclude a renewal of the maximum on the American session.

On Thursday I went for a fall in the euro to 1.1137, with a subsequent bounce to 1.1170. Whilst the euro is weakening, the LB will be nearing the 45th degree by 14:00 EET and will offer support to the euro bulls.

Source:: Correction for euro