Crude Edges Higher Following Solid Inventory Draws

Crude oil prices move higher on Wednesday following a stronger than expected draw in crude oil inventories. Although petroleum stocks remain near all-time highs, there are some clues that the trajectory of stock levels are likely to decline. Demand for products remains strong and the technical picture looks solid as prices attempt to form a rounded bottom.

Rig count continue to decline, which means that it will be harder for domestic producer to ramp up even if prices climb. Rigs engaged in exploration and production in the U.S. totaled 894 for the week ended May 8, 2015. This was down by 11 from the previous weeks rig count and indicates the lowest level in almost 6 years. Additionally, imports in general have been declining. Over the last four weeks, crude oil imports averaged about 7.2 million barrels per day, 2.2% below the same four-week period last year.

Inventory levels are also drawing in crude and gasoline. U.S. commercial crude oil inventories decreased by 2.2 million barrels from the previous week, in line with expectations. At 484.8 million barrels, U.S. crude oil inventories are at the highest level for this time of year in at last the last 80 years. Gasoline inventories decreased by 1.1 million barrels last week, while distillate fuel inventories decreased by 2.5 million barrels last week.

Demand remains solid especially for gasoline ahead of the unofficial driving season. Total product demand over the last four-week period averaged 19.4 million barrels per day, up by 3.6% from the same period last year. Over the last four weeks, gasoline demand averaged over 9.0 million barrels per day, up by 3.0% from the same period last year. Distillate fuel demand averaged about 4.1 million barrels per day over the last four weeks, down by 0.5% from the same period last year. Jet fuel demand is up 9.0% compared to the same four-week period last year.

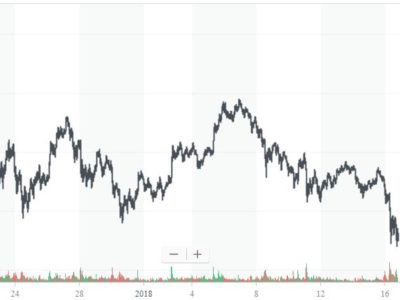

The technical picture shows crude oil prices testing the 38.2% Fibonacci retracements which measures the decline from the highs near $105 to the most recent lows at $42.50. The next target is $65.68, while support is seen near the 20-day moving average at $58.50.

The post Crude Edges Higher Following Solid Inventory Draws appeared first on Forex Circles.