Crude Oil Whipsaws Following EIA Energy Report

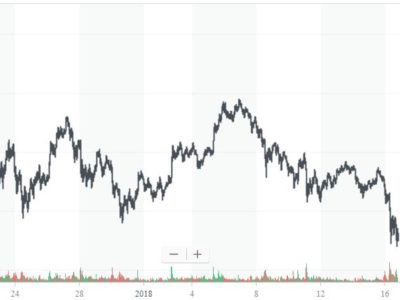

Crude oil prices whipsawed on Wednesday first moving higher to test $46.30, and then moving lower following a stronger than expected inventory report from the Energy Information Adminstration. Prior to the close prices rallied back after testing support near the $43.21 level.

According to the Department of Energy, U.S. commercial crude oil inventories increased by 4.7 million barrels from the previous week. Total gasoline inventories decreased by 0.3 million barrels last week, and are in the middle of the 5-year average range. Distillate fuel inventories increased by 0.1 million barrels last week but are in the middle of the 5-year average range for this time of year. Total commercial petroleum inventories increased by 5.7 million barrels last week.

On the demand front, total products demand over the last four-week period averaged 20.3 million barrels per day, up by 2.9% from the same period last year. Over the last four weeks, gasoline demand averaged 9.5 million barrels per day, up by 4.8% from the same period last year. The negative surprise was that distillate fuel demand averaged 3.7 million barrels per day over the last four weeks, down by 5.3% from the same period last year. People are continuing to fly which is reflected in the Jet fuel number which showed that demand increased by 2.3% compared to the same four-week period last year.

The post Crude Oil Whipsaws Following EIA Energy Report appeared first on Forex Circles.