Daily analysis of major pairs for May 29, 2017

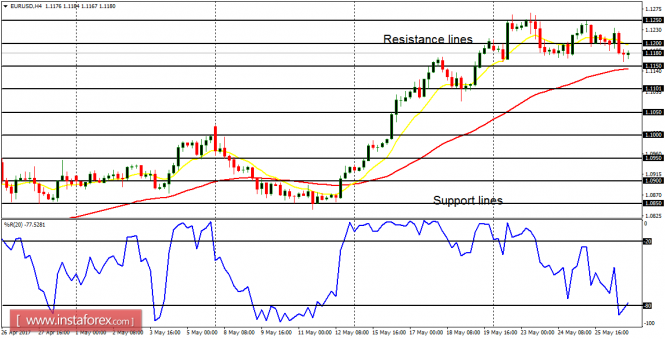

EUR/USD: This pair moved

sideways last week, oscillating between the support line at 1.1150 and the

resistance line at 1.1250. The resistance line at 1.1250 was tested several

times without success but, it would be breached to the upside this week. The

outlook on EUR pairs is bearish for June (though some EUR pairs would make

bullish attempts). It is expected that the resistance line at 1.1250 would be

breached to the upside this week.

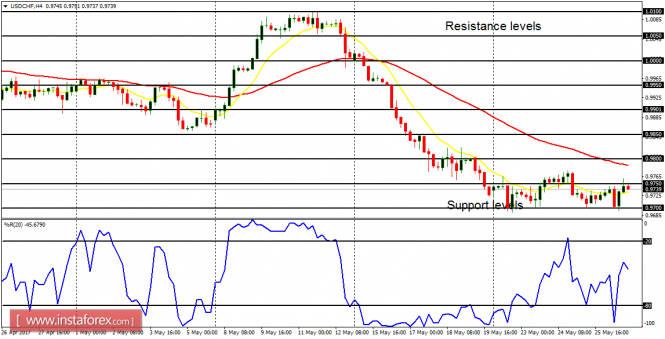

USD/CHF: This currency trading

instrument consolidated last week, testing the support level at 0.9700 several

times without breaking it to the downside, and also not going above the

resistance level at 0.9800. The Greenback is supposed to become weak this week;

while the Swissie would be strong: Hence a bearish movement on the USD/CHF. The

support level at 0.9700 would be breached to the downside this week as price

goes further south. However, this trend would be reversed when the EUR/USD

plummets in June.

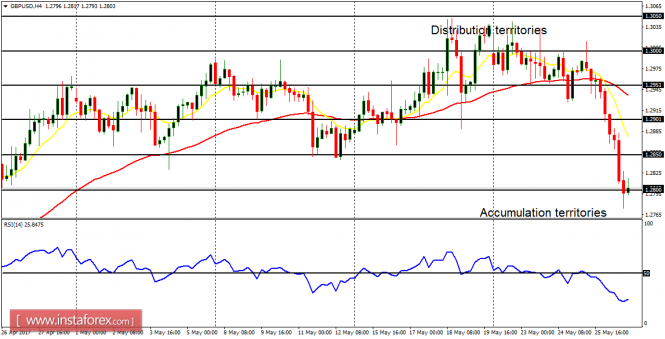

GBP/USD: The GBP/USD moved

sideways from Monday to Wednesday and then began to come down on Thursday.

Price went downwards from the distribution territory at 1.3000 towards the

accumulation territory at 1.2800 (a drop of 200 pips). The outlook on GBP pairs

is bearish for this week and for the month of June 2017. Though the markets are

supposed to become quiet in June, GBP pairs would trend seriously.

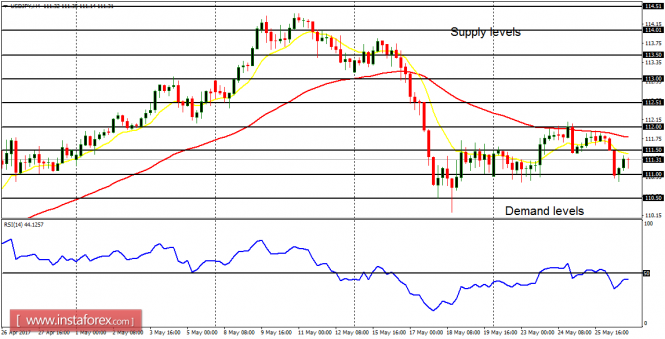

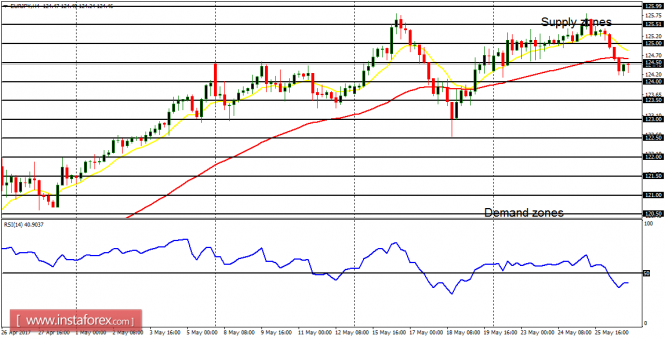

USD/JPY: Last week, this currency trading instrument

went between the supply level at 112.00 and the demand level at 111.00. The

bias is bearish in the short-term and neutral in the long-term. The demand

level at 111.00 would be breached to the downside as the instrument becomes

weaker. The markets would generally become quiet in June. However, JPY pairs

would trend nicely.

EUR/JPY: The EUR/JPY did not

do anything significant last week, save the shallow bearish run that was seen

on May 26. It is possible that price would go upwards this week, but that is

limited, owing to the expected bearishness in the market. The outlook on JPY

pair is bearish for June 2017, and the EUR.JPY may lose about 300 pips within

the next two weeks, potentially leading to the end of the current bullish bias

on the market.

The material has been provided by InstaForex Company – www.instaforex.com